7 Factors of a Housing Market Crash

1. Economic Recession

A major economic recession can have a domino effect on the housing market. When an economy contracts, unemployment rises, wages stagnate, and consumer spending drops—all of which impact people's ability to buy homes or service their existing mortgages. Recessions also erode consumer confidence, discouraging potential buyers from entering the market. The Great Recession of 2008 serves as a prime example, where the economic downturn crippled the housing market globally.

2. Excessive Speculation

Speculation in the housing market occurs when investors buy properties with the sole aim of flipping them for a profit, often driving up prices beyond sustainable levels. When speculative bubbles burst, the inflated prices plummet, leaving investors with devalued assets. This phenomenon was particularly evident during the early 2000s, when over-leveraged speculative investments led to widespread foreclosures.

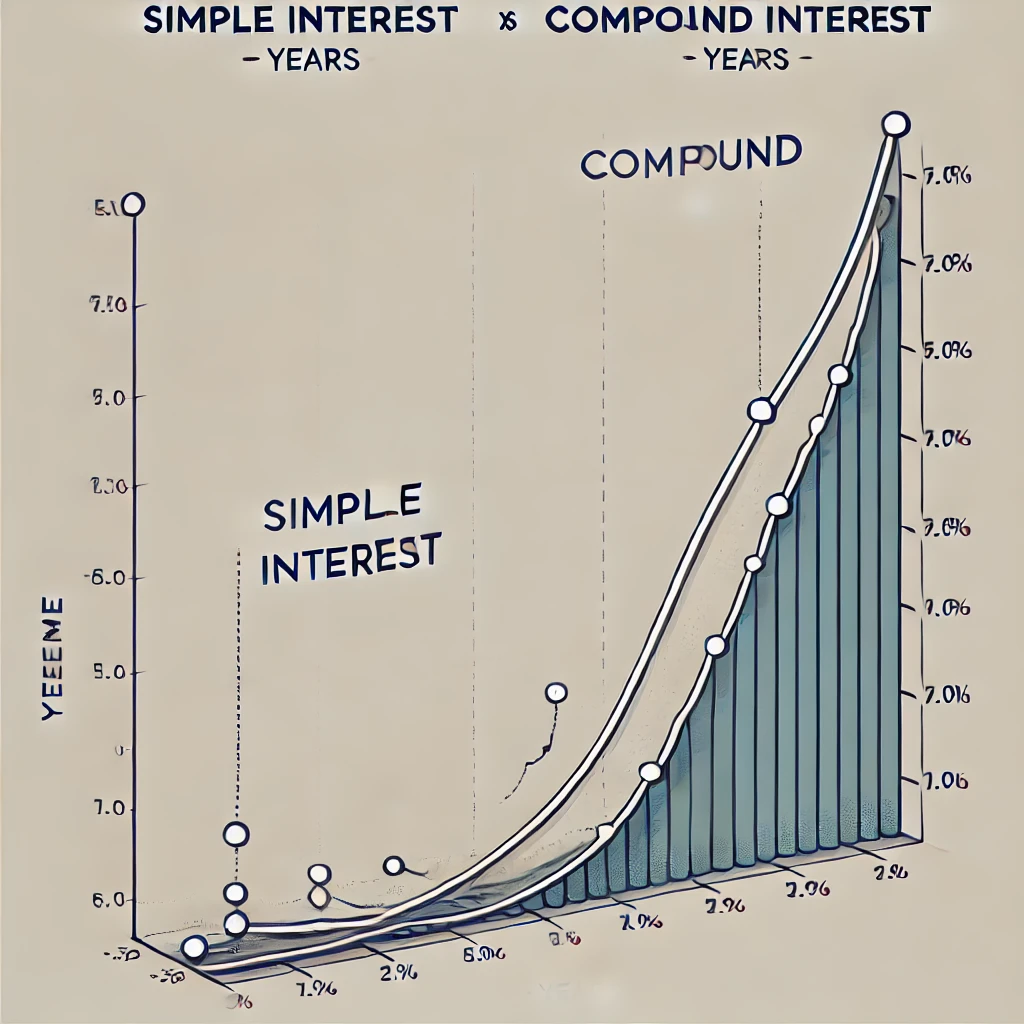

3. Interest Rate Spikes

Higher interest rates make mortgages more expensive, reducing affordability for homebuyers. When rates rise suddenly, existing homeowners with adjustable-rate mortgages (ARMs) can see their monthly payments skyrocket, leading to defaults. A sharp rise in interest rates not only curbs demand but also increases the supply of distressed properties in the market, driving prices down further.

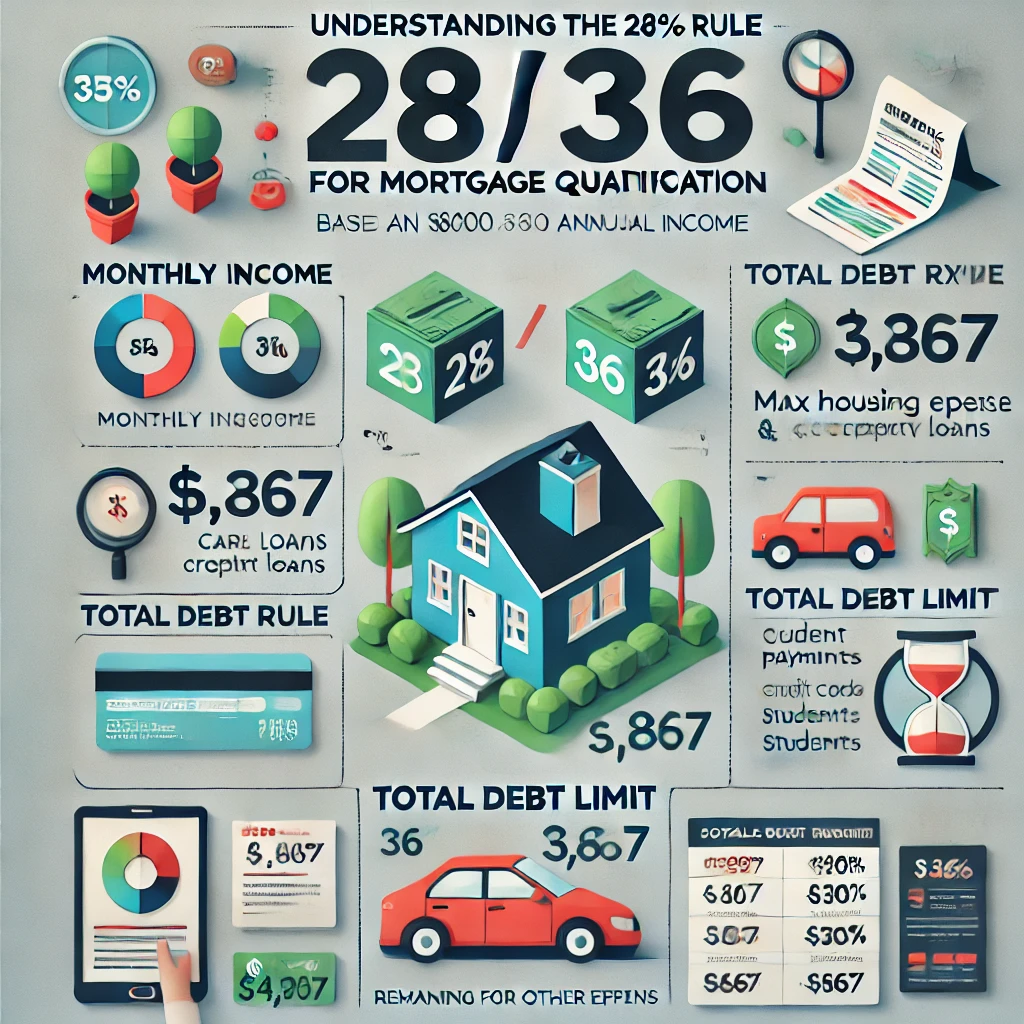

4. Loose Lending Standards

Poor lending practices, such as offering subprime mortgages to borrowers with weak credit histories, are a significant contributor to housing crashes. When loans are issued without adequate assessment of a borrower’s ability to repay, defaults rise, which can destabilize the broader housing market. The 2008 crash is largely attributed to loose lending practices that created a fragile foundation for sustained market growth.

5. Overbuilding and Oversupply

An oversupply of homes can flood the market, reducing demand and driving down prices. Developers may overbuild during periods of high demand, assuming that the trend will continue indefinitely. However, if demand slows or halts, the excess inventory can remain unsold, contributing to a market crash. This was seen in markets like Las Vegas during the 2008 crisis, where empty housing developments became symbols of oversupply.

6. External Shocks

Unforeseen global events, such as a pandemic, war, or natural disaster, can severely disrupt the housing market. For example, the COVID-19 pandemic initially froze the market, although government interventions mitigated a crash. External shocks can disrupt income stability, limit access to financing, and create uncertainty, which collectively hamper housing activity.

7. Declining Population Growth

Demographics play a key role in housing demand. A slowdown in population growth, or an aging population, reduces the pool of homebuyers, impacting long-term market stability. Countries with low birth rates or emigration trends may face housing market stagnation or decline. Japan’s shrinking population is a notable example of how demographic shifts can depress property values.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "