First-Time Homebuyer? Avoid These 5 Costly Mistakes!

Buying your first home is exciting—but it’s also one of the biggest financial decisions you’ll ever make. And let’s be real… it’s easy to make mistakes when you’re navigating this process for the first time.

I’ve seen way too many first-time buyers lose money, stress out, or even miss out on their dream home because of simple (but costly) missteps. Don’t be that buyer!

In this guide, I’m sharing the top 5 mistakes first-time buyers make—AND how to avoid them!

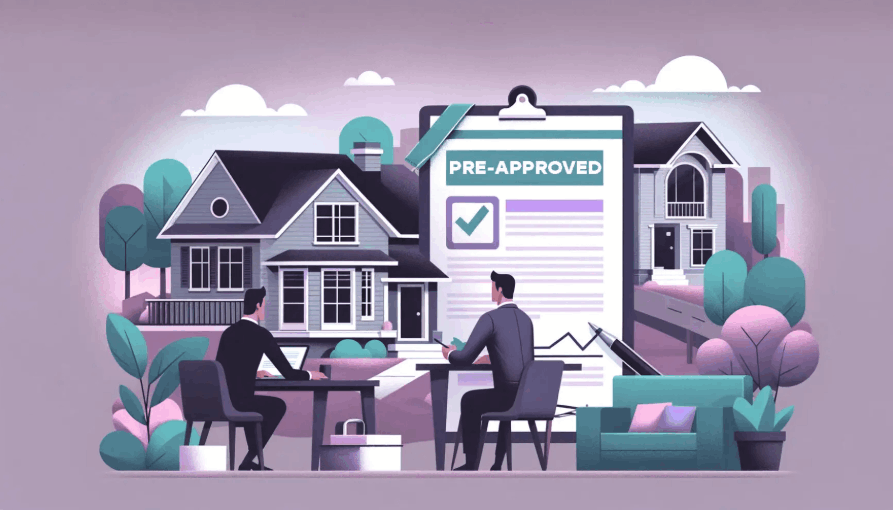

Mistake #1: Not Getting Pre-Approved First

So many first-time buyers start house hunting before talking to a lender—huge mistake!

What happens if you skip pre-approval?

🔹 You fall in love with a home you can’t afford 😢

🔹 You risk losing a house to a pre-approved buyer

🔹 You don’t know your real budget or mortgage rate

How to Avoid It:

✔ Talk to a lender first & get pre-approved BEFORE looking at homes.

✔ Know your budget so you only look at homes you can afford.

✔ Lock in your interest rate for 90-120 days while you shop.

💡 Pro Tip: A pre-approval makes you a stronger buyer, especially in a competitive market!

Mistake #2: Forgetting About Closing Costs

You saved for your down payment, but what about closing costs? Many first-time buyers forget that they need extra cash to actually close the deal!

What are closing costs?

💰 Legal fees & land transfer tax

💰 Home inspection & appraisal fees

💰 Property taxes & home insurance

How to Avoid It:

✔ Budget 1.5% – 4% of the home price for closing costs.

✔ Ask your realtor for a breakdown of expected costs before you buy.

💡 Pro Tip: Some first-time buyer programs help reduce closing costs—ask your lender!

Mistake #3: Letting Emotions Take Over

It’s easy to fall in love with a home at first sight… but buying based on emotions instead of logic can lead to bad financial decisions.

What happens if you let emotions control your decision?

🔹 You might overpay just because you love the kitchen 😬

🔹 You could ignore red flags like hidden damages or a bad location

🔹 You end up with a home that doesn’t fit your long-term needs

How to Avoid It:

✔ Stick to your must-have list and don’t settle for features you don’t need.

✔ Always compare prices with similar homes in the area.

✔ Think about the long-term value of the home, not just how it looks today.

💡 Pro Tip: Bring a trusted friend or family member to house showings for a second opinion!

Mistake #4: Skipping the Home Inspection

In a hot market, some buyers skip the home inspection just to win a bidding war. BIG mistake! You never know what’s hiding beneath the surface.

What can go wrong without an inspection?

🔹 Foundation issues = $10K+ in repairs

🔹 Leaky roof = Major water damage

🔹 Old wiring = Fire hazards & extra costs

How to Avoid It:

✔ Always include a home inspection condition in your offer.

✔ Hire a qualified inspector who checks everything—from plumbing to electrical.

✔ If the market is competitive, consider a pre-offer inspection (where you inspect before making an offer).

💡 Pro Tip: A $400-$600 home inspection can save you thousands in unexpected repairs!

Mistake #5: Ignoring Future Resale Value

Buying a home isn’t just about what you love now—it’s also about how well it will sell in the future!

Why does resale value matter?

🔹 You might need to sell sooner than planned (job relocation, life changes, etc.)

🔹 A home in a bad location can be harder to sell later

🔹 Homes with unusual layouts or missing key features lose value over time

How to Avoid It:

✔ Location matters! Homes near schools, transit, and amenities hold value better.

✔ Think about who would buy this home after you—does it appeal to future buyers?

✔ Avoid homes that need too much renovation to be livable.

💡 Pro Tip: Even if this is your “forever home,” life happens. Buy smart!

Final Thought – Have a Smooth Home Buying Journey

Buying a home is more than just securing a mortgage—it’s about being financially prepared for the long haul. By understanding these hidden costs of homeownership, you can make smarter decisions and avoid unexpected financial stress.

Knowledge is power! The more you plan ahead, the smoother your home-buying experience will be. Stay informed, stay prepared, and step into homeownership with confidence!

Save this guide & DM me "FIRST HOME" for expert advice!

📢 Which mistake surprised you the most? Drop your thoughts in the comments! ⬇️

#FirstTimeHomeBuyer #HomeBuyingMistakes #RealEstateTips #BuyingAHouse #YYCRealtorAfroz #CalgaryRealEstate #TheCoupleState 🚀

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "