Understanding the Home Buying Process

The First-Time Homebuyer’s Guide: Understanding the Home Buying Process

Thinking about buying your first home? 🏡✨ It’s exciting, but let’s be real—it can also feel overwhelming and confusing. Where do you even start? How much do you need? What’s the actual process like?

I get it. I’ve helped so many first-time buyers who had the same questions—and today, I’m breaking it all down for you in 5 simple steps so you can go from dreaming about a home to actually owning one! Let’s dive in.

Thinking about buying your first home? 🏡✨ It’s exciting, but let’s be real—it can also feel overwhelming and confusing. Where do you even start? How much do you need? What’s the actual process like?

I get it. I’ve helped so many first-time buyers who had the same questions—and today, I’m breaking it all down for you in 5 simple steps so you can go from dreaming about a home to actually owning one! Let’s dive in.

Step 1: Know Your Budget 💰 – What Can You Afford?

Before you even start scrolling through homes on Realtor.ca (I know, we all do it 😆), you need to understand your budget.

✅ Check your credit score – A score of 680+ gets you the best mortgage rates. If it's lower, work on improving it before applying.

✅ Calculate your affordability – Use an online mortgage calculator to see how much you can borrow based on your income, debts & down payment.

✅ Save for your down payment – In Canada, you need at least 5% down for homes under $500K. But don’t forget closing costs!

💡 Pro Tip: Always budget for closing costs (1.5%–4% of the home price) for legal fees, inspections & taxes.

Step 2: Find a Realtor 🤝 – The Right Guide Makes All the Difference

You wouldn’t hike a mountain without a guide—so why navigate the real estate market alone? A great realtor can save you thousands!

🔹 They help you find hidden deals (some homes don’t even hit the market!).

🔹 They negotiate on your behalf so you don’t overpay.

🔹 They handle all the paperwork & conditions (trust me, it’s A LOT).

💡 Pro Tip: Find a realtor who specializes in first-time buyers. They’ll walk you through the entire process and make sure you don’t miss anything!

Step 3: Start House Hunting 🔎 – Finding “The One”

Okay, now the fun part—house hunting! But before you start booking showings, have a clear game plan:

🏡 Make a list of must-haves vs. nice-to-haves (Bedrooms? Garage? Home office?)

📍 Research neighborhoods (Commute time? Schools? Future developments?)

👀 Visit open houses & book private showings (A home can look VERY different in person vs. photos).

💡 Pro Tip: Don’t get emotionally attached to a home too soon! Stay logical, compare options, and always think long-term.

Step 4: Make an Offer ✍️ – The Art of Negotiation

You found “the one” – now what? It’s time to make an offer!

✔ Understand the market – Are you in a buyer’s or seller’s market? This will determine how aggressive your offer should be.

✔ Include conditions – Home inspection & financing conditions protect you!

✔ Work with your realtor to negotiate the best price.

💡 Pro Tip: Your first offer isn’t always final! There’s usually room to negotiate on price, conditions, or closing dates.

Step 5: Closing the Deal 🔑 – It’s Almost Yours!

Once your offer is accepted, you’re in the final stretch! But before you pop the champagne, there are a few more steps:

✅ Home inspection – Make sure there are no hidden issues.

✅ Finalize your mortgage – Your lender will complete the final approval process.

✅ Legal paperwork & closing costs – Your lawyer will handle the title transfer, and you’ll pay the final fees.

🎉 Move-in day arrives… and just like that, YOU’RE A HOMEOWNER!

Final Thoughts – Ready to Buy?

Buying your first home doesn’t have to be stressful. When you follow the right steps & work with the right people, the process is actually exciting and rewarding!

Thinking about buying? DM me “FIRST HOME” or book a call—I’d love to help!

Did you find this guide helpful? Let me know in the comments what step you’re currently on! ⬇️

Categories

Recent Posts

Thinking About Buying a Home? Get Pre-Approved First!

First-Time Homebuyer? Avoid These 5 Costly Mistakes!

Understanding the Home Buying Process

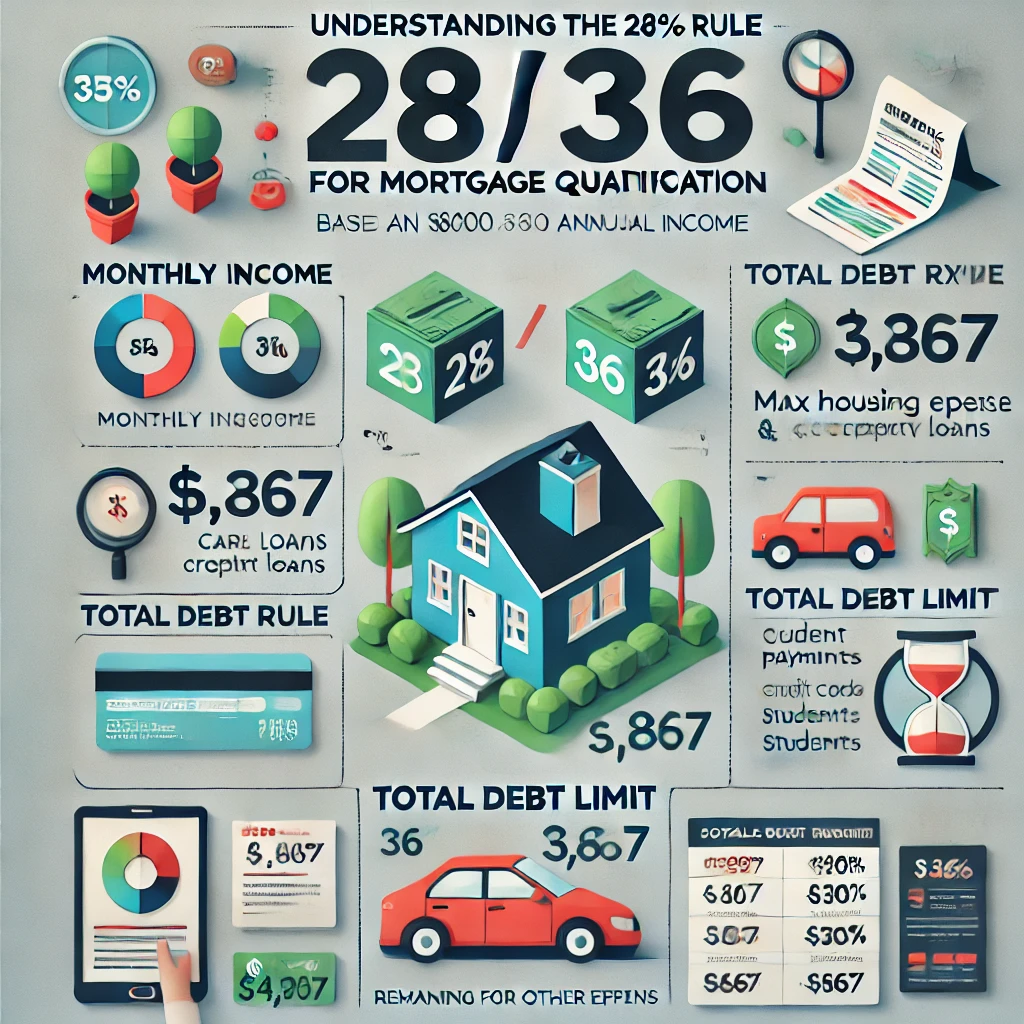

How Much House Can I Buy on $80K Per Year? A Guide to Home Affordability

Extreme Weather’s Impact on Real Estate Ownership

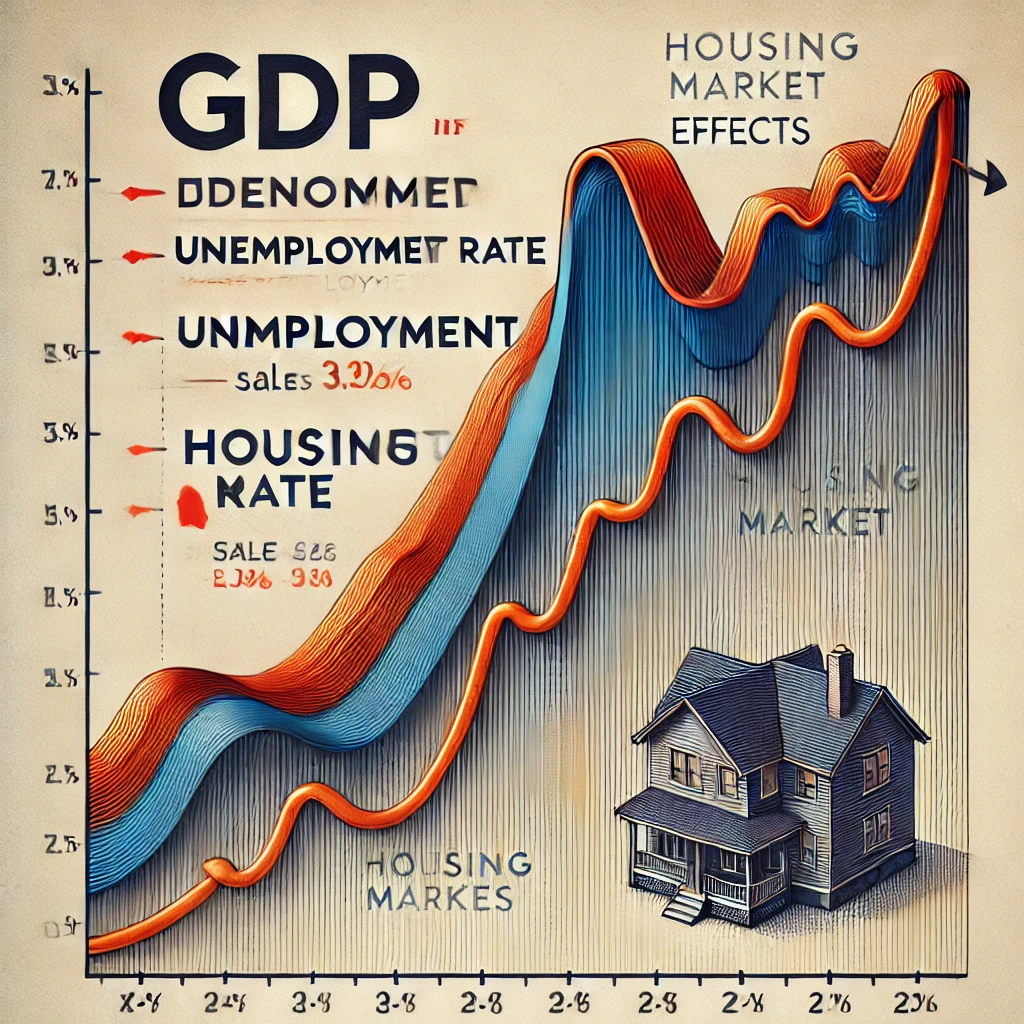

7 Factors of a Housing Market Crash

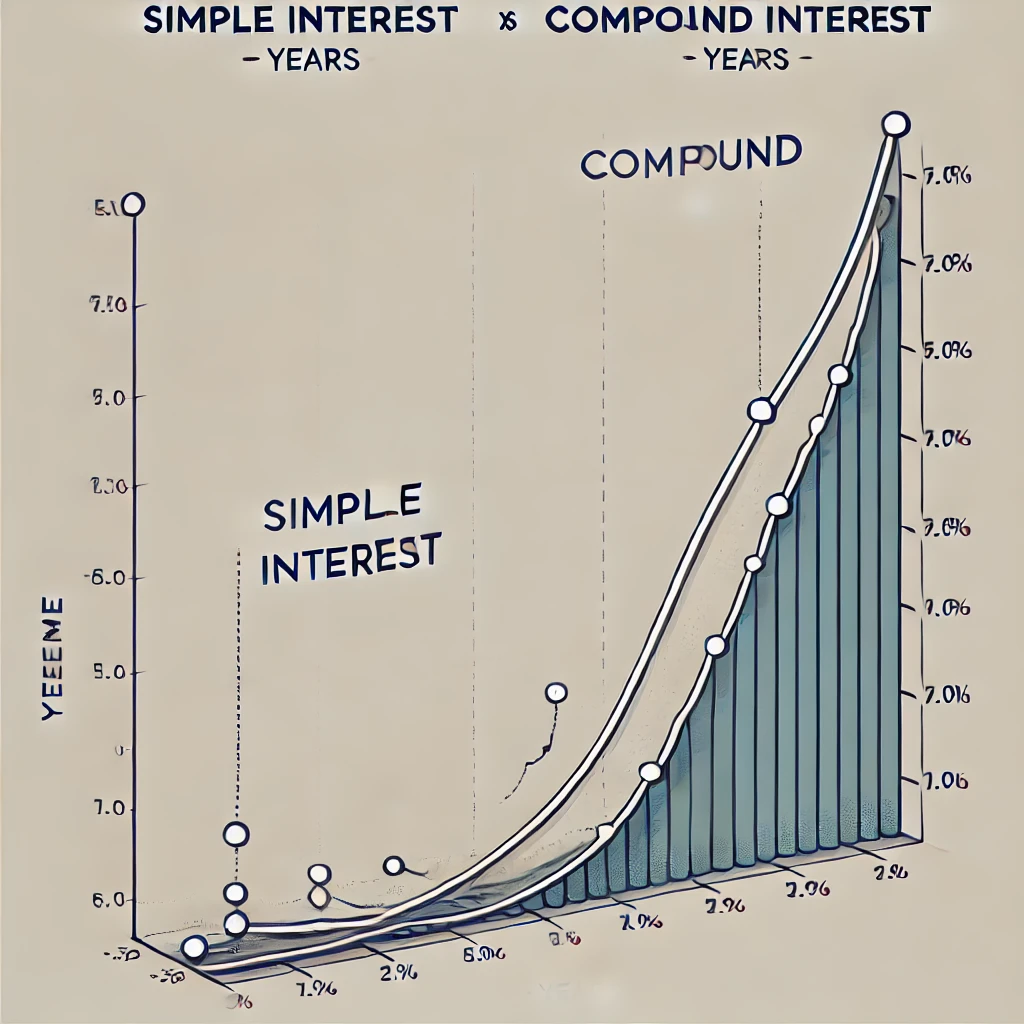

How Does Compound Interest Work?

How to Retire Rich: The Math Behind Financial Freedom

The TRUTH About Your 401(k): 2020 Update

Surviving a Seller’s Market: Buyer Tactics for 2025

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "