Thinking About Buying a Home? Get Pre-Approved First!

So, you’re ready to buy a home? That’s exciting! 🎉 But before you start scrolling through listings and picturing yourself in that dream house, there’s one crucial step you need to take first—getting pre-approved for a mortgage!

Skipping pre-approval is like shopping without knowing your budget—you might fall in love with a home you can’t afford or miss out on one because another buyer was ready. Let’s make sure that doesn’t happen! Here’s everything you need to know about mortgage pre-approval.

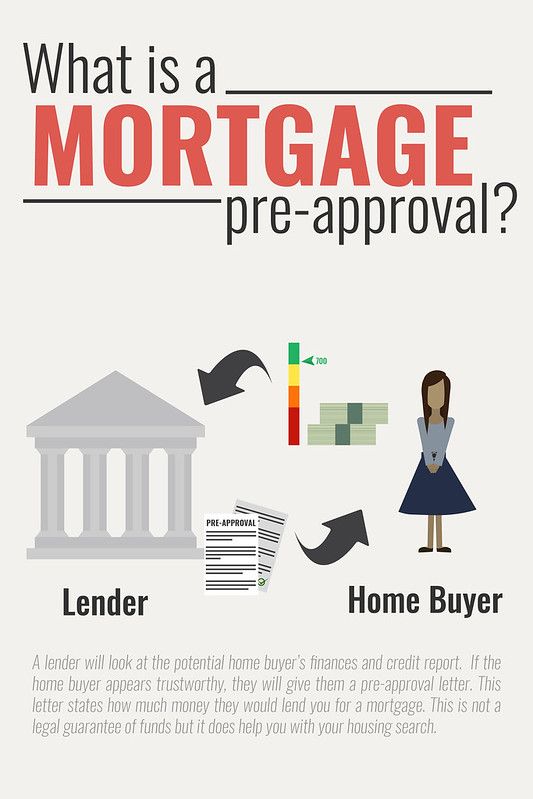

What is Mortgage Pre-Approval?

A mortgage pre-approval is a lender’s way of saying, “Based on your income, credit score, and financial situation, you’re approved to borrow up to $X amount.”

Why is it important?

✅ Know your budget – No more guessing how much you can afford.

✅ Lock in an interest rate – Protect yourself from rate hikes for 90–120 days.

✅ Be a strong buyer – Sellers take pre-approved buyers more seriously.

💡 Pro Tip: Pre-approval is NOT the same as final approval. Your lender will still verify your finances once you make an offer!

How to Get Pre-Approved for a Mortgage

🚀 Follow these 5 simple steps to get pre-approved & house hunt with confidence:

✅ Step 1: Check Your Credit Score 📊

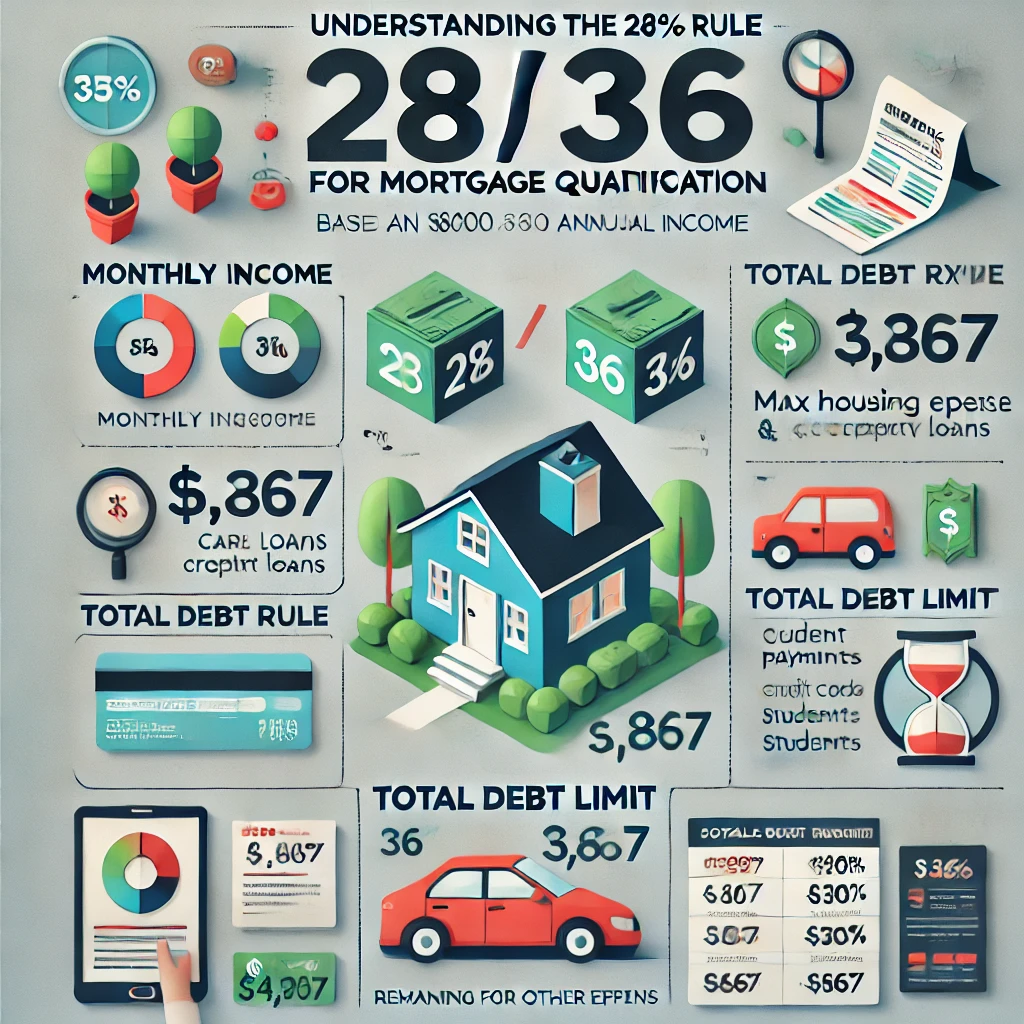

Your credit score impacts your mortgage interest rate. The higher your score, the better the rates!

📌 Score 680+? You’ll qualify for better loan options.

📌 Lower than 680? You may need a larger down payment or a backup plan.

💡 Pro Tip: Check your score for free on sites like Borrowell or Equifax before applying!

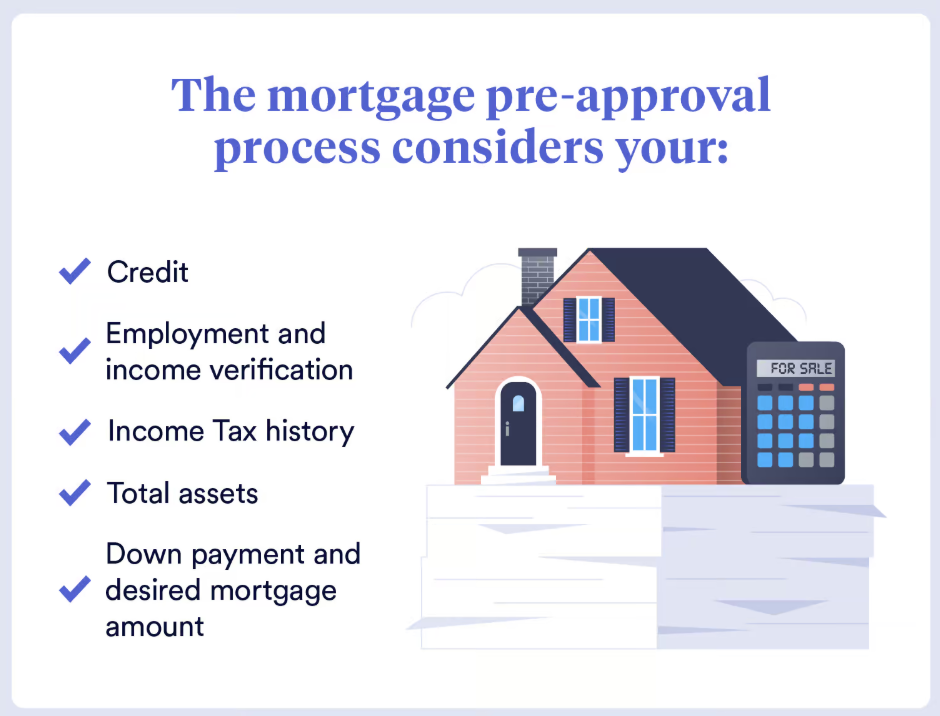

✅ Step 2: Gather Your Documents 📑

Lenders need to see proof of your income & financial health. Be ready with:

✔ Proof of income (pay stubs, tax returns)

✔ Employment verification (letter from employer)

✔ Bank statements (savings, debt, investments)

✔ Debt information (credit cards, car loans, student loans)

💡 Pro Tip: The less debt you have, the better your chances of qualifying for a higher mortgage!

✅ Step 3: Choose the Right Lender 🏦

Not all lenders are the same! You can choose between:

🏦 Banks – Stricter approval but lower rates.

💼 Mortgage Brokers – They shop around for the best rates & options.

💡 Pro Tip: Compare at least 3 lenders before deciding to get the best deal!

✅ Step 4: Get Your Pre-Approval Letter 📜

Once your lender reviews your application, they’ll issue a pre-approval letter stating:

✔ Your maximum mortgage amount

✔ Your estimated interest rate

✔ The duration of pre-approval (typically 90–120 days)

💡 Pro Tip: Don’t max out your pre-approved amount! Stay within a budget that allows for comfortable monthly payments.

✅ Step 5: Start House Hunting with Confidence 🏡

Now that you’re pre-approved, you can shop for homes that fit your budget! 🎉

🔹 Work with your realtor to find the best options.

🔹 Stay realistic about what you can afford.

🔹 Be ready to act fast in competitive markets!

💡 Pro Tip: Pre-approval gives you an edge in multiple-offer situations! Sellers love buyers who are already financially approved.

Common Mortgage Pre-Approval Mistakes to Avoid

🚨 Mistake 1: Making big purchases (like a car) before closing – This can impact your loan approval!

🚨 Mistake 2: Changing jobs before closing – Lenders want stable income.

🚨 Mistake 3: Assuming pre-approval = guaranteed loan – Final approval still depends on home appraisal & financial checks.

Final Thoughts – Ready to Get Pre-Approved?

Pre-approval is the key to a stress-free home-buying experience! It helps you stay within budget, lock in a great mortgage rate, and make competitive offers with confidence.

Pre-approval is the key to a stress-free home-buying experience! It helps you stay within budget, lock in a great mortgage rate, and make competitive offers with confidence.

📩 Thinking about buying? DM me “MORTGAGE” or book a call—I’ll connect you with the best mortgage experts!

📢 What’s your biggest concern about getting pre-approved? Drop a comment below! ⬇️

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "