How to Retire Rich: The Math Behind Financial Freedom

Why Retiring Rich Is Possible for Anyone

Retiring rich may seem like a distant dream, but with the right financial plan and consistent effort, it’s achievable for almost anyone. The key lies in understanding the numbers behind financial freedom. Whether you’re starting from scratch or already have some savings, the math behind retiring rich centers on three pillars: your savings rate, the power of compound interest, and time. In this post, we’ll break down these concepts step by step and show how they interact to shape your financial future. By the end, you’ll have a clear roadmap to achieving wealth and retiring on your terms.

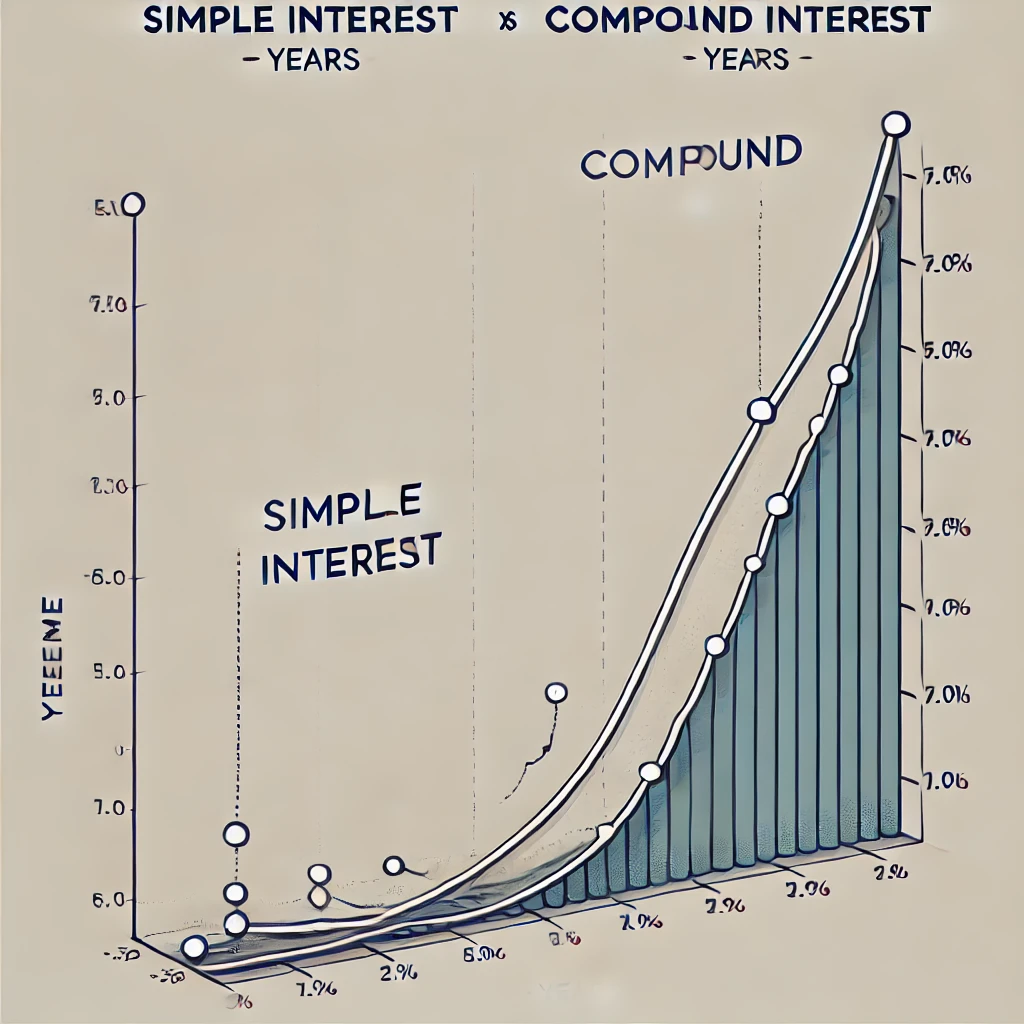

1. The Magic of Compound Interest: Your Money’s Growth Multiplier

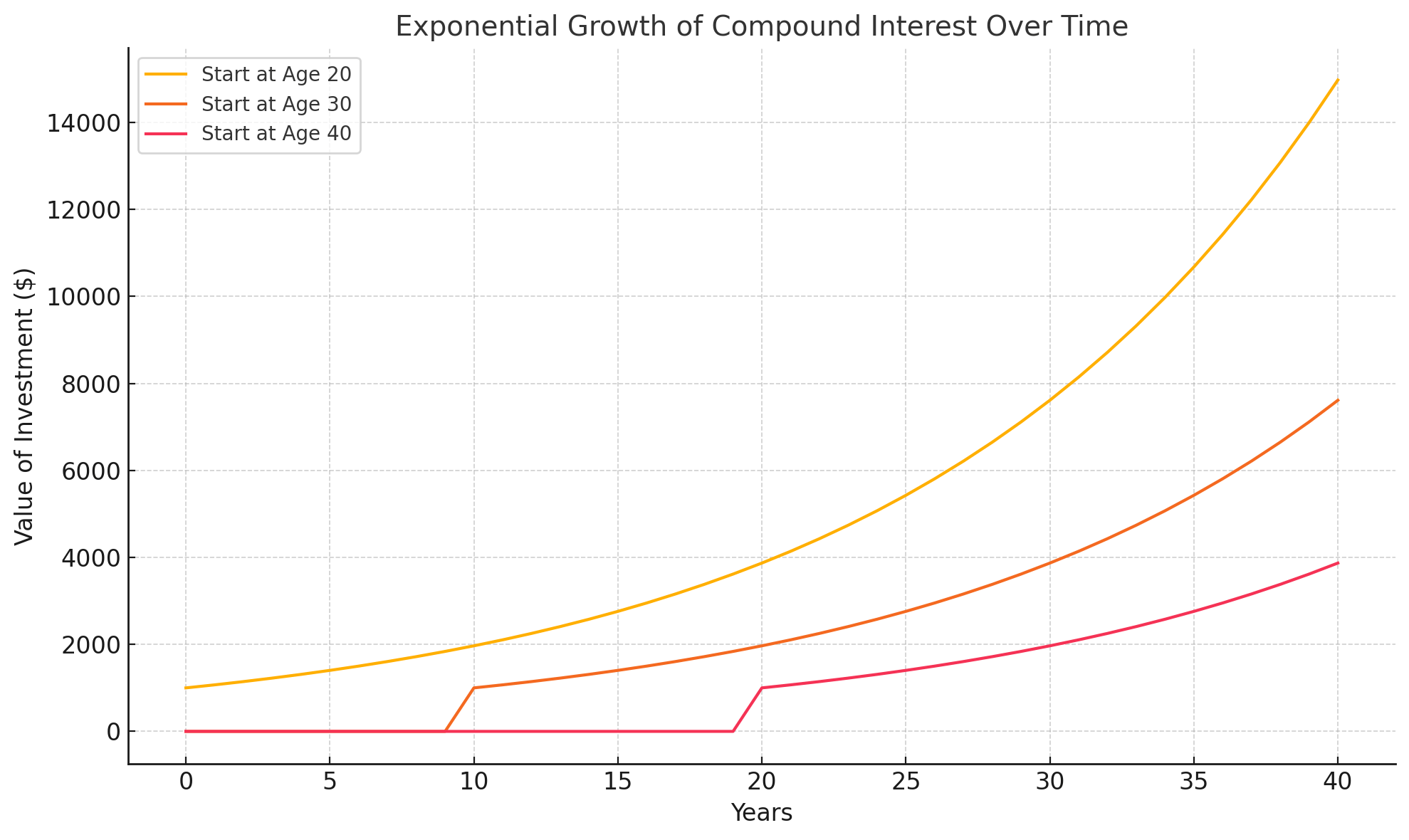

One of the most powerful tools in your financial arsenal is compound interest. Simply put, this is when your investments earn returns, and those returns start earning their own returns. For example, if you invest $10,000 at an 8% annual return, you’ll have over $21,000 in 10 years—without adding another dime. Now imagine if you contribute consistently over 20 or 30 years. The results are exponential.

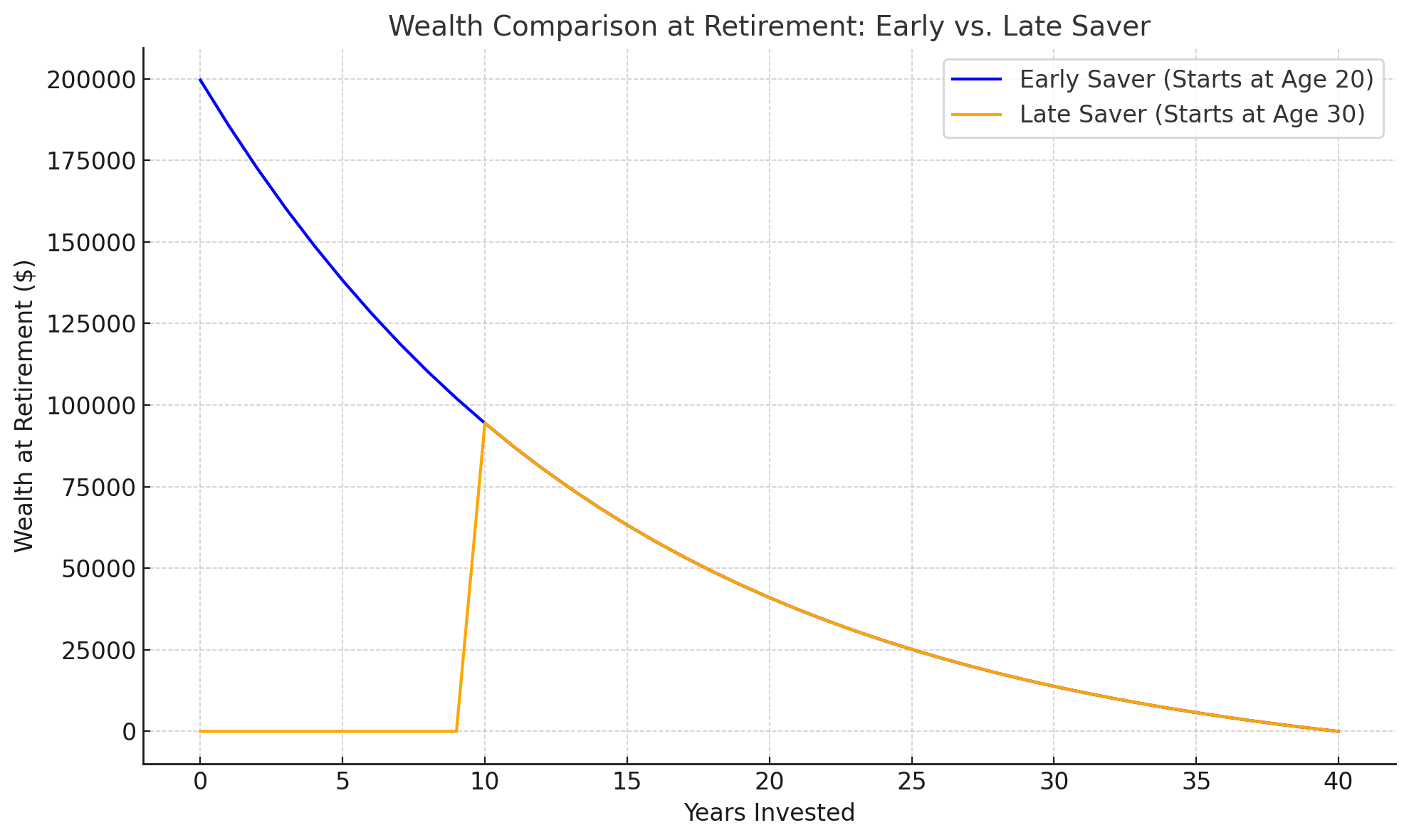

To maximize compound interest, start as early as possible. Even small contributions early in your career can outweigh larger contributions made later in life. This concept is often referred to as the “time value of money.” The earlier you begin, the less you need to save overall to reach your financial goals.

2. Savings Rate: The Biggest Predictor of Wealth

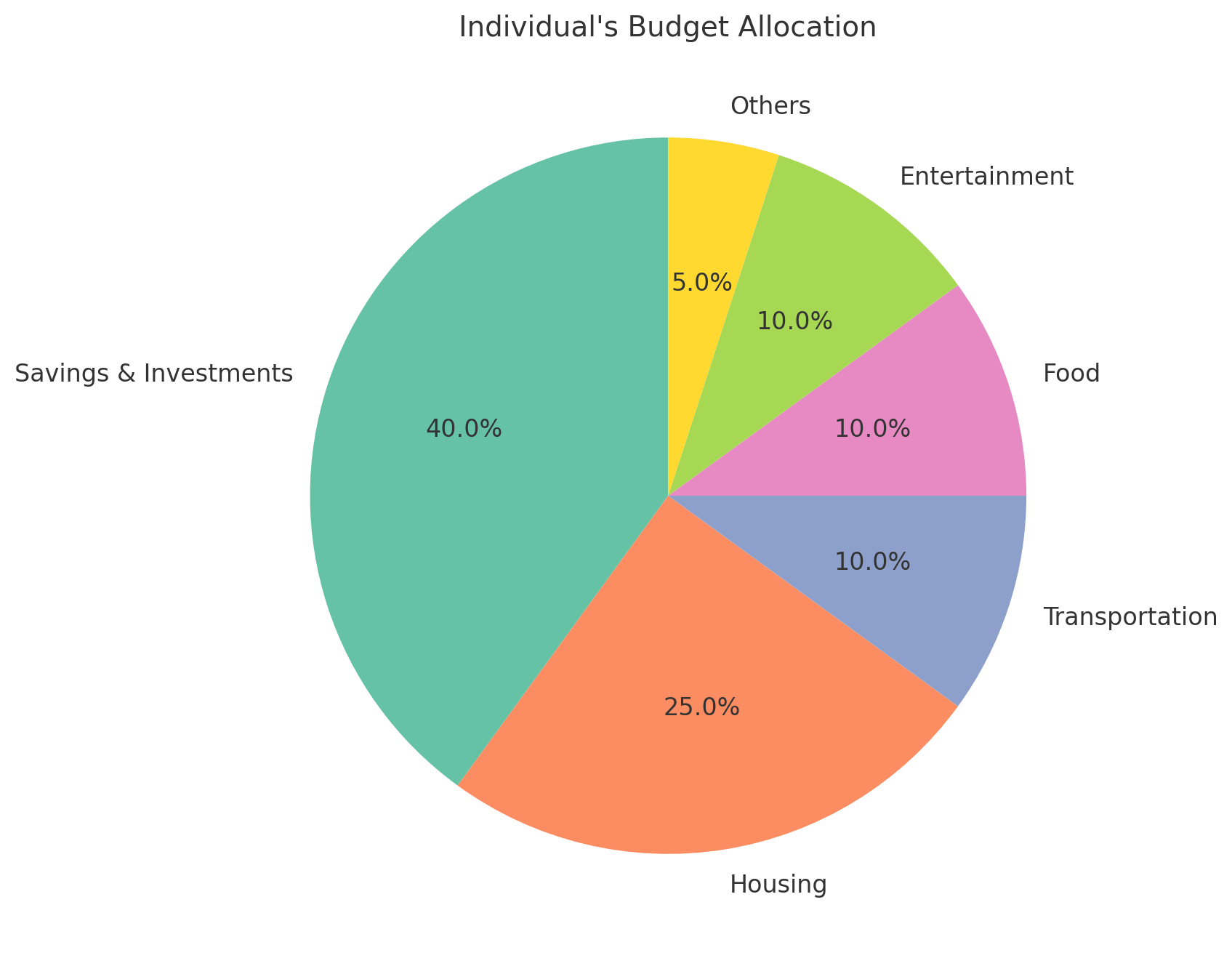

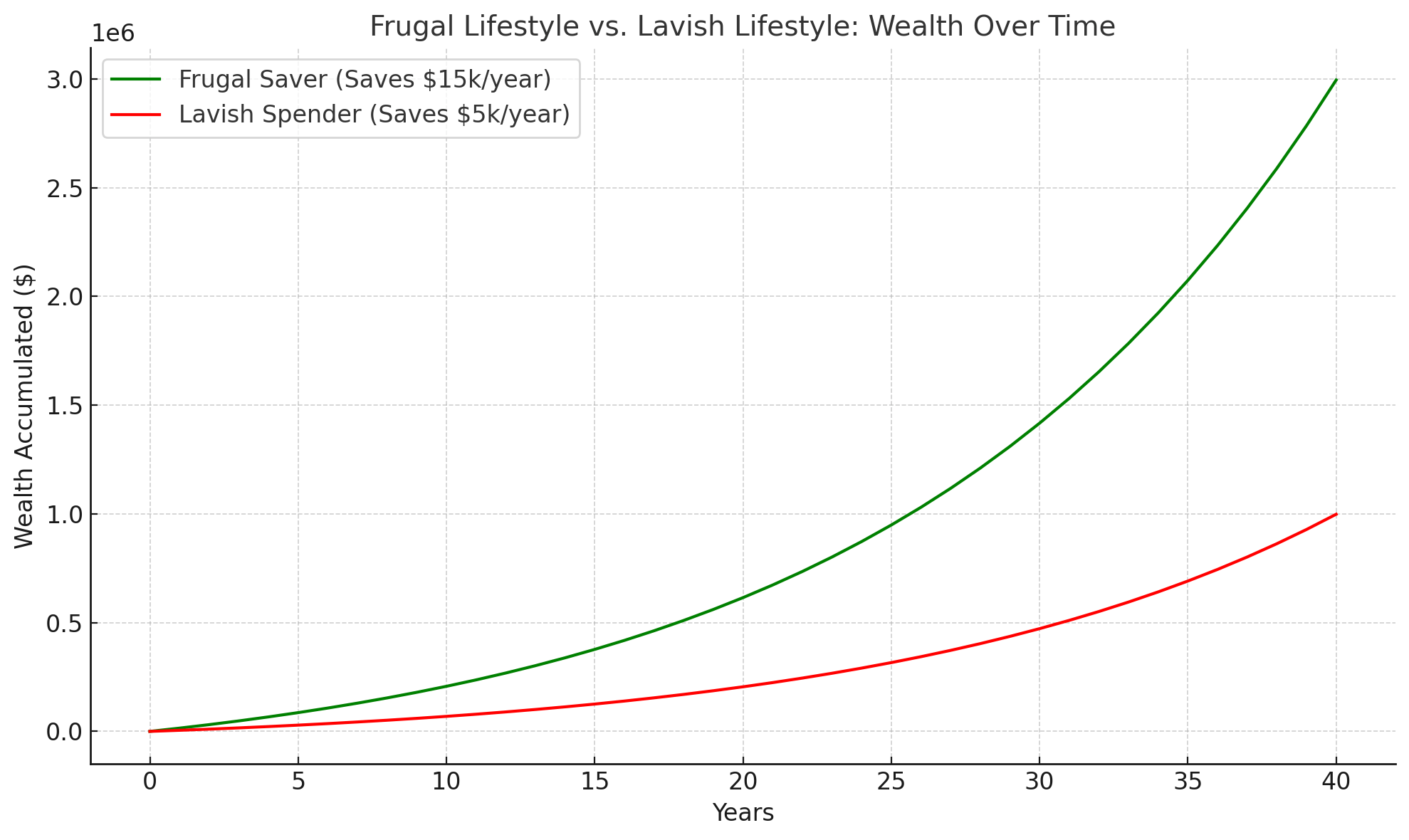

While investment returns are important, your savings rate plays a more significant role in building wealth, especially early on. Your savings rate is the percentage of your income that you set aside for investments and retirement. A higher savings rate not only increases the amount you invest but also lowers your required future expenses, speeding up the path to financial independence.

For example, if you save 50% of your income, you could theoretically retire in about 17 years, assuming your investments yield average market returns. Contrast this with someone saving just 10%, who might need over 50 years. The difference in outcomes highlights how impactful your savings habits are.

3. The Role of Time: Start Early, Retire Rich

The amount of time you have until retirement is one of the most critical factors in your financial plan. Starting early gives you the advantage of decades of compound growth. Consider two individuals: one starts saving $500/month at age 25, while the other begins the same amount at age 35. The younger saver will have almost twice as much money by age 65, even though both contributed the same amount monthly.

However, even if you’re starting later, it’s never too late to take action. Catch-up contributions, side hustles, and aggressive savings strategies can help close the gap. The earlier you take control of your finances, the easier it becomes to achieve financial independence.

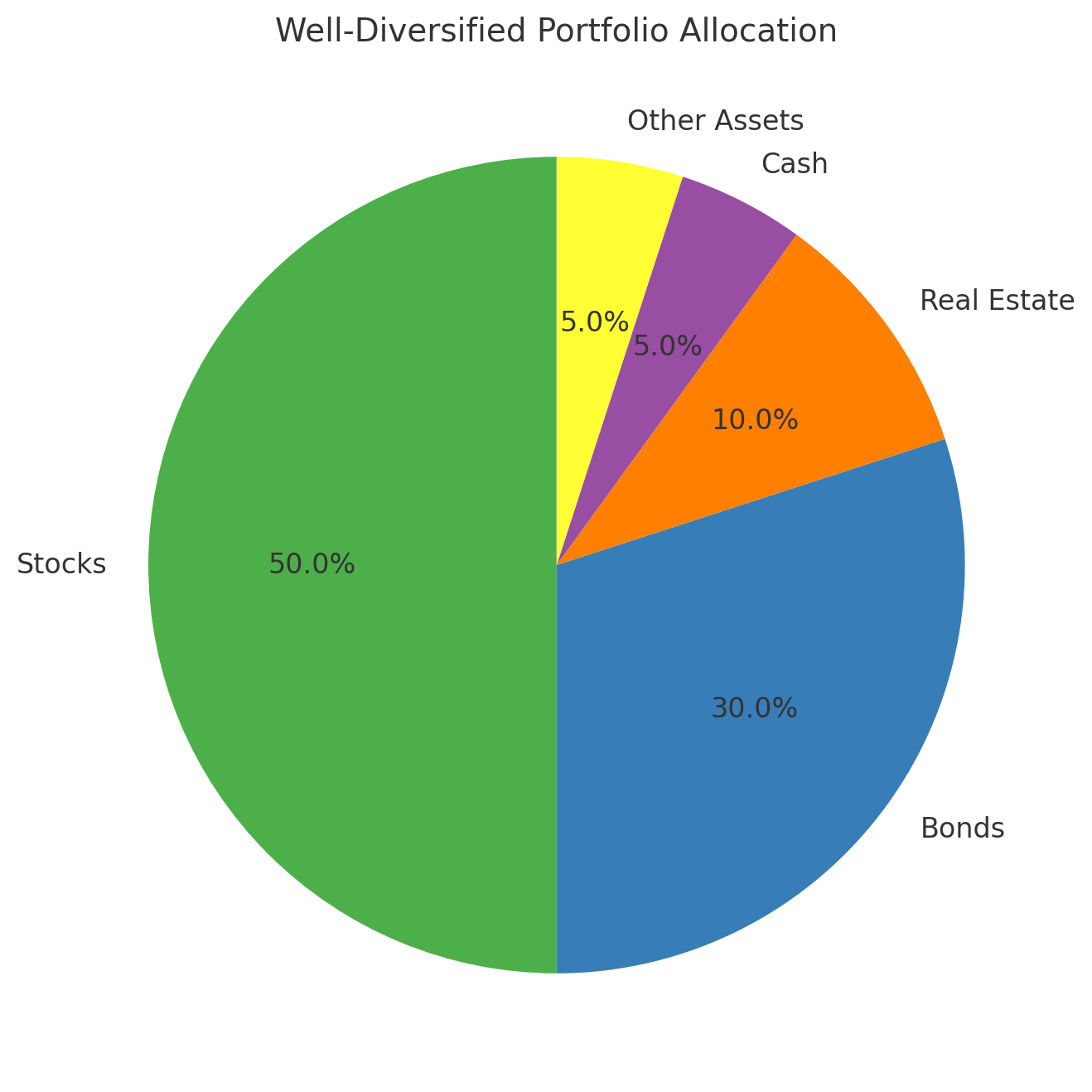

4. Investment Strategy: Diversify and Optimize for Growth

To retire rich, you need to ensure your investments are working hard for you. This means building a diversified portfolio that includes stocks, bonds, and possibly real estate. Historically, the stock market has delivered an average return of about 7–10% annually after inflation. By balancing risk and return based on your age and goals, you can optimize growth while minimizing potential losses.

One common approach is the "80/20" rule for young investors—allocating 80% of investments to stocks and 20% to bonds. As you age, the allocation gradually shifts toward more conservative investments. Additionally, minimizing fees, reinvesting dividends, and regularly rebalancing your portfolio are essential practices.

5. Avoiding Lifestyle Inflation: A Hidden Wealth Killer

Lifestyle inflation—spending more as you earn more—is one of the biggest obstacles to retiring rich. Many people fall into the trap of upgrading their lifestyle instead of investing their pay raises. The key is to maintain a modest lifestyle, even as your income grows, and channel the extra money into your investments.

For instance, if you receive a $5,000 annual raise, allocating the entire amount to your retirement account rather than increasing your spending can significantly shorten your timeline to financial freedom. By living below your means and prioritizing saving and investing, you can achieve your financial goals faster.

Conclusion: Take Action Today for a Wealthy Tomorrow

The math behind retiring rich is simple but powerful. By leveraging compound interest, maintaining a high savings rate, starting as early as possible, and adopting a disciplined investment strategy, anyone can achieve financial freedom. It’s not about earning a six-figure salary—it’s about how much you save, invest, and allow time to work in your favor. Remember, the best time to start was yesterday. The second best time is today.

If you’re ready to take the first step, start by calculating your current savings rate, creating a budget, and setting achievable financial goals. From there, the path to retiring rich is just a matter of discipline and consistency.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "