How Does Compound Interest Work?

What is Compound Interest?

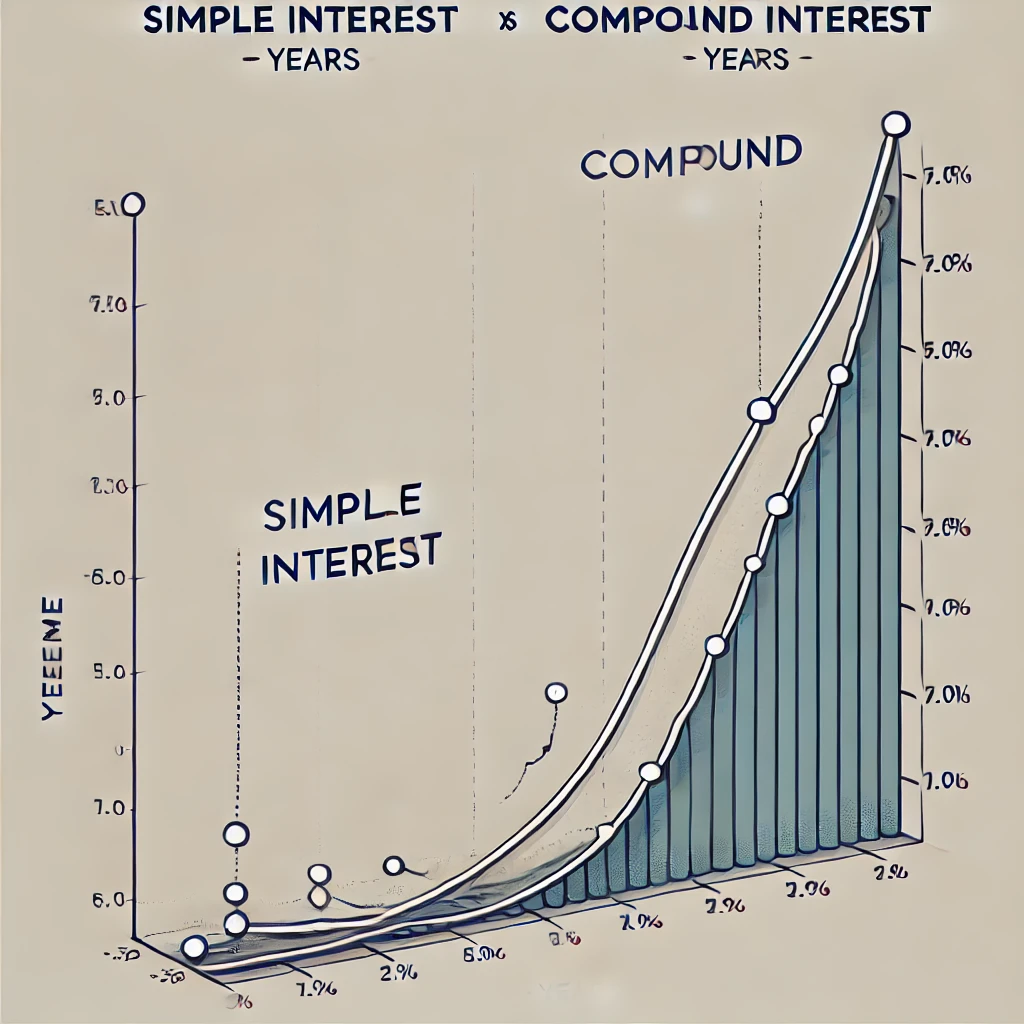

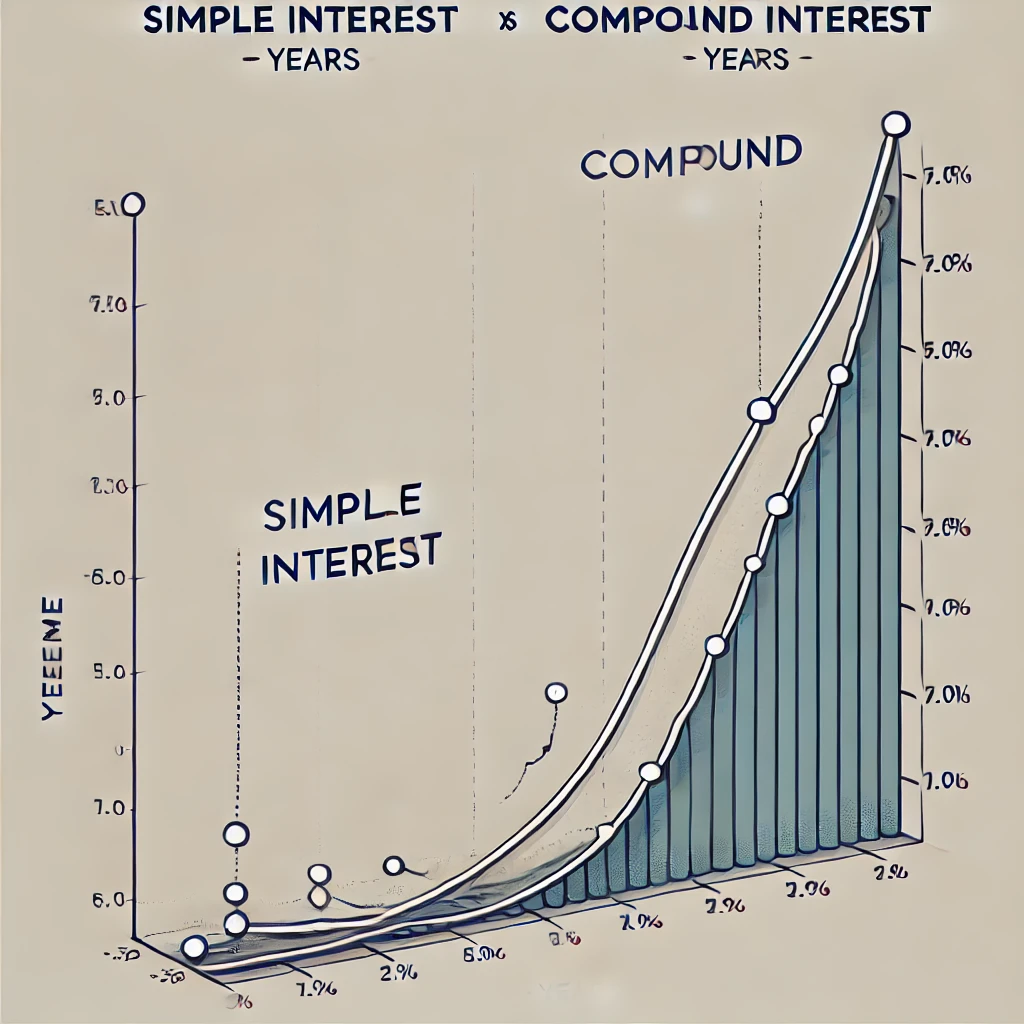

At its core, compound interest is interest calculated on both the initial principal and the previously accumulated interest. It enables your money to grow faster over time compared to simple interest. The formula for compound interest is:

A = P(1 + r/n)^(nt)

Where:

- A is the future value of the investment or loan, including interest.

- P is the principal amount (the initial deposit or loan).

- r is the annual interest rate (in decimal form).

- n is the number of times interest is compounded per year.

- t is the time the money is invested or borrowed for, in years.

For example, if you invest $1,000 at an annual interest rate of 5%, compounded annually, you’ll have $1,276.25 after 5 years. That’s $76.25 more than if the interest were calculated simply on the principal.

The Magic of Compounding Over Time

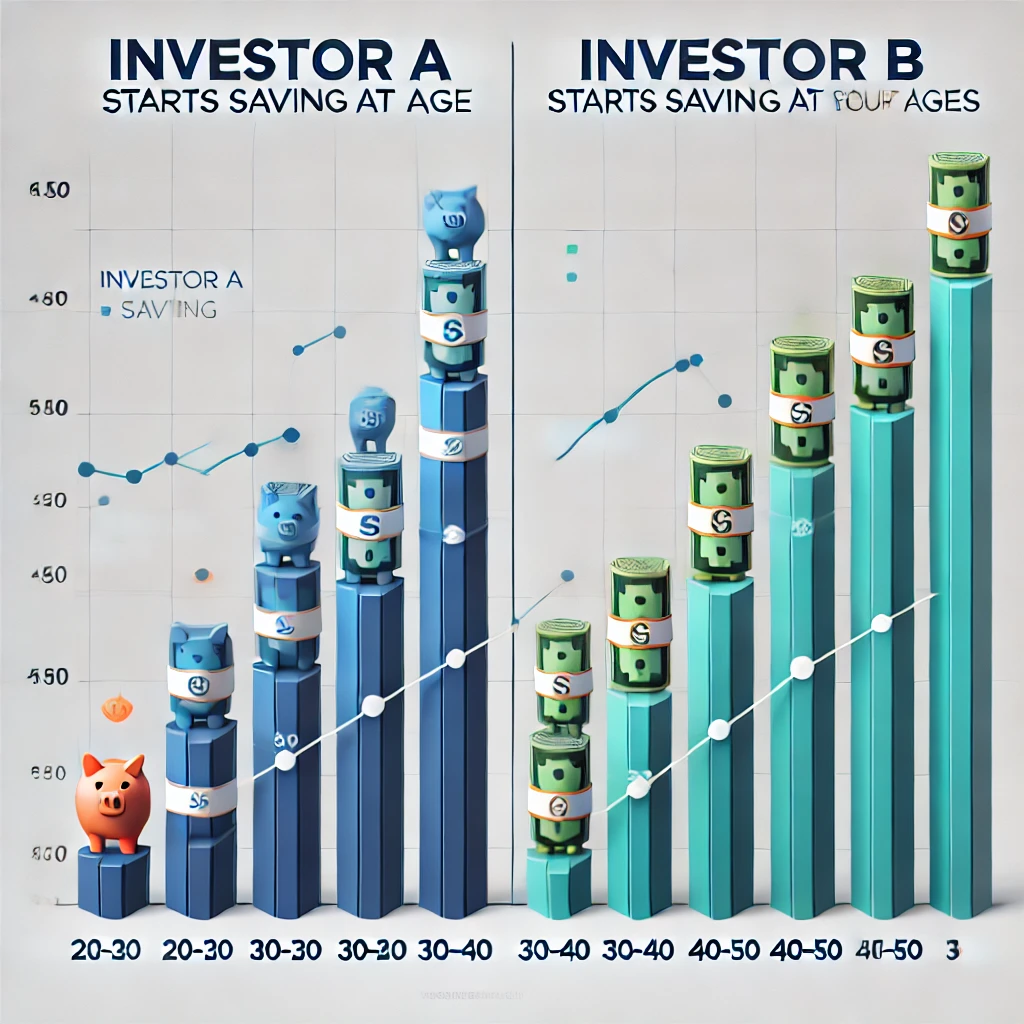

The most critical factor in maximizing compound interest is time. The longer your money stays invested, the more significant the effect of compounding. This is why starting early is so crucial for building wealth. A small investment made in your 20s can grow into a substantial amount by retirement, even with modest interest rates.

For example, imagine two individuals, Alex and Jamie. Alex starts investing $200 per month at age 25 and stops at age 35, while Jamie starts investing $200 per month at age 35 and continues until age 65. Even though Alex invested for only 10 years, their portfolio outgrows Jamie’s by retirement because the earlier start gave compound interest more time to work.

Factors That Influence Compound Interest

Several factors affect how much your money grows with compound interest. These include:

- Interest Rate: Higher interest rates lead to faster growth, but they also come with greater risk when investing.

- Compounding Frequency: Interest compounded more frequently (e.g., monthly or daily) accumulates faster than interest compounded annually.

- Investment Period: The longer you leave your investment untouched, the more compound interest will amplify your returns.

- Additional Contributions: Regularly adding to your initial investment significantly enhances growth potential.

Understanding these factors can help you make better financial decisions. For instance, opting for investments with higher compounding frequencies or contributing more over time can dramatically boost your savings.

Conclusion

Compound interest is a cornerstone of wealth-building, and understanding how it works can empower you to take control of your financial future. Whether you’re saving for retirement, building an emergency fund, or paying off debt, compound interest can either be your greatest ally or your biggest challenge. By starting early, investing consistently, and making informed financial choices, you can harness the power of compound interest to grow your wealth exponentially over time.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "