Home Buyer’s Guide: Your Path to Owning a Home

Buying a home is an exciting journey, and I’m here to make it as smooth and enjoyable as possible. Whether you’re looking for your first home, upsizing, or investing, this guide will walk you through each step in the process. From understanding your financing options to navigating the market, making offers, and finally closing on your dream home, I’ll be here to answer your questions and provide guidance. Purchasing a home involves many decisions, but with the right support, it can be a rewarding experience. This guide is designed to help you feel informed and empowered at every stage, so you can make confident choices along the way.

1. Getting to Know Your Needs

- Your Home Wishlist:

- We’ll start by discussing your preferences: the type of home, number of bedrooms and bathrooms, neighborhood features, and any must-haves.

- Your Financial Comfort Zone:

- Together, we’ll determine a comfortable budget range based on factors like down payment, monthly payments, and other financial goals.

- Understanding the Home Buying Process

The buying process typically follows these six stages, from starting your search to settling into your new home:

- Stage 1: Pre-Approval

- Why it Matters: Getting pre-approved by a lender gives you a clear picture of your buying power and shows sellers you're a serious buyer.

- How to Do It: We’ll connect you with a trusted lender who can discuss your financing options.

- Stage 2: The Home Search

- Online and In-Person Viewings: You’ll be able to browse listings and visit properties. I’ll also preview homes that match your criteria, and we can attend open houses.

- What to Look For: We’ll help you consider factors like location, layout, condition, and future resale value.

- Stage 3: Making an Offer

- Offer Strategy: We’ll work together to create a competitive offer based on market insights and your budget.

- Negotiations: If needed, we’ll negotiate on price, terms, or conditions to secure the best deal.

- Stage 4: Due Diligence and Inspections

- Home Inspection: This crucial step helps you understand the condition of the home and uncover any potential issues.

- Additional Inspections: Depending on the property, we may recommend specific inspections, such as radon testing, termite inspection, or a sewer line check.

- Stage 5: Financing and Final Approval

- Appraisal: Your lender will conduct an appraisal to ensure the property’s value aligns with the loan amount.

- Final Financing Steps: We’ll work with the lender to meet all loan requirements and finalize your financing.

- Stage 6: Closing Day and Moving In

- Final Walkthrough: You’ll inspect the property one last time before closing to make sure everything is in order.

- Closing: This is where we finalize the paperwork, transfer ownership, and hand you the keys!

- Important Considerations Along the Way

- Budgeting Beyond the Purchase Price: Besides the down payment, consider monthly mortgage payments, property taxes, homeowner’s insurance, and maintenance costs.

- Timing: Think about when you’d ideally like to move and how this timing affects your offer and financing.

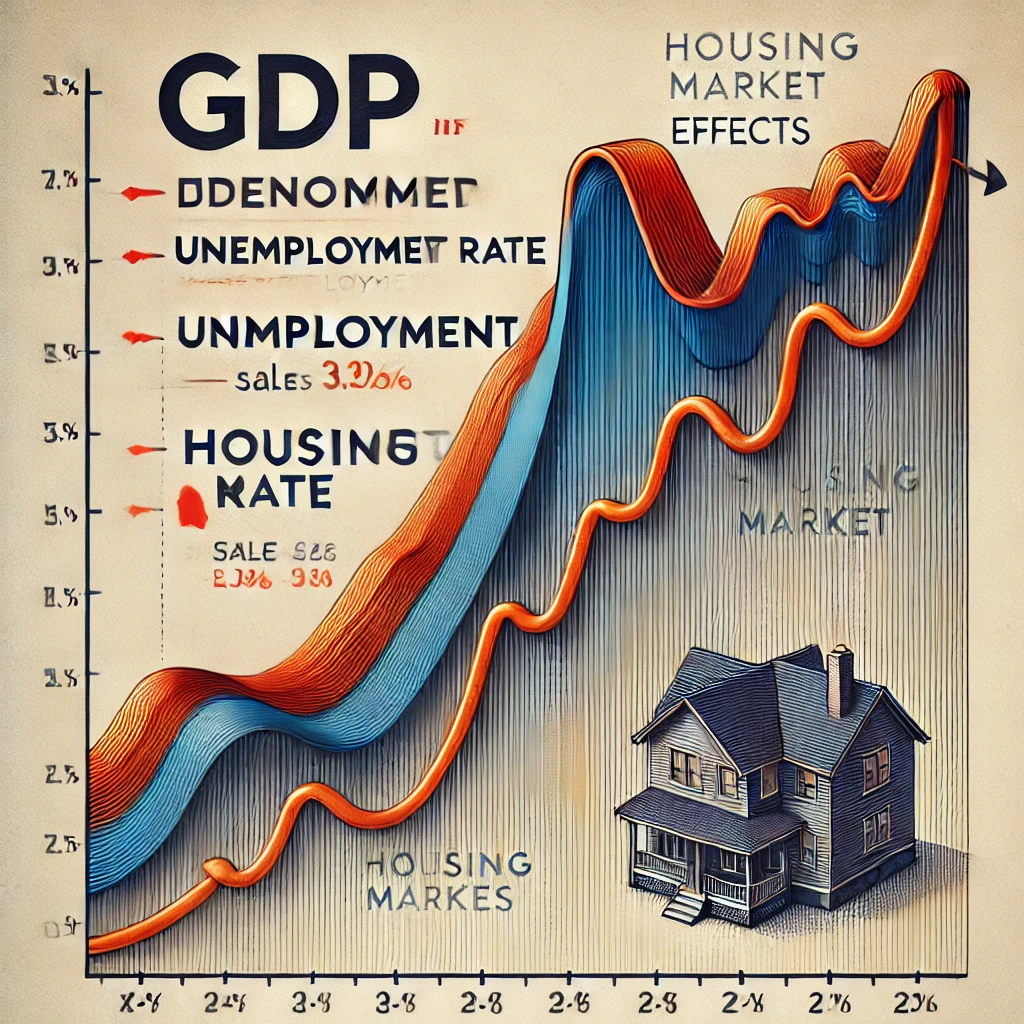

- Market Trends: We’ll keep you updated on market conditions to make informed decisions on timing and pricing.

- My Commitment to You

As your real estate agent, here’s how I’ll help you through each step of this journey:

- Personalized Property Search: I’ll preview homes and find off-market listings to give you an edge.

- Professional Network: I’ll connect you with trusted lenders, inspectors, and legal experts to ensure a smooth process.

- Negotiation and Advocacy: I’m here to negotiate for your best interests and advocate for you at every turn.

- Simplifying Paperwork: From offer letters to closing documents, I’ll manage the paperwork and keep everything organized.

- Practical Checklists for Each Step

- Initial Viewing Checklist:

- Bring a notepad to jot down your first impressions and ask any questions about the property.

- Offer Preparation Checklist:

- We’ll review comparable sales and set up an offer strategy that’s both competitive and within your budget.

- Closing Preparation Checklist:

- Make sure to schedule the final walkthrough, and gather necessary funds for closing.

Each stage has a checklist to ensure nothing is overlooked!

- Ready to Start? Let’s Make Your Dream Home a Reality!

The journey to owning your home can be thrilling and straightforward with the right guidance. I’m here to ensure a smooth, enjoyable experience so that you can feel confident and excited every step of the way.

FAQs

- How long does the home-buying process take?

- The process varies but typically takes 30-60 days from making an offer to closing, depending on factors like financing, negotiations, and inspections.

- How much money do I need for a down payment?

- Down payments generally range from 5% to 20% of the home price, depending on the type of loan and your financial situation.

- What’s the difference between pre-qualification and pre-approval?

- Pre-qualification is an estimate of your borrowing capacity, while pre-approval is a more thorough review from a lender that gives you a specific loan amount and interest rate.

- What factors should I consider when choosing a neighborhood?

- Key factors include commute times, schools, safety, nearby amenities (like grocery stores, parks, and hospitals), and future development plans.

- What is included in closing costs, and how much should I budget?

- Closing costs generally range from $2000 to $2500 and include fees for appraisals, inspections, title insurance, lender fees, and attorney fees.

- How does an appraisal affect the home-buying process?

- The appraisal ensures the property is worth the loan amount. If the appraisal comes in low, you may need to renegotiate with the seller or cover the difference.

- What if issues are found during the home inspection?

- You can negotiate with the seller to make repairs, offer a credit, or reduce the price. Alternatively, you can walk away if the issues are significant and not addressed.

- Should I buy a home warranty?

- A home warranty can cover repairs for major appliances and systems in the first year, offering peace of mind. They are often optional, depending on your preference and the home’s condition.

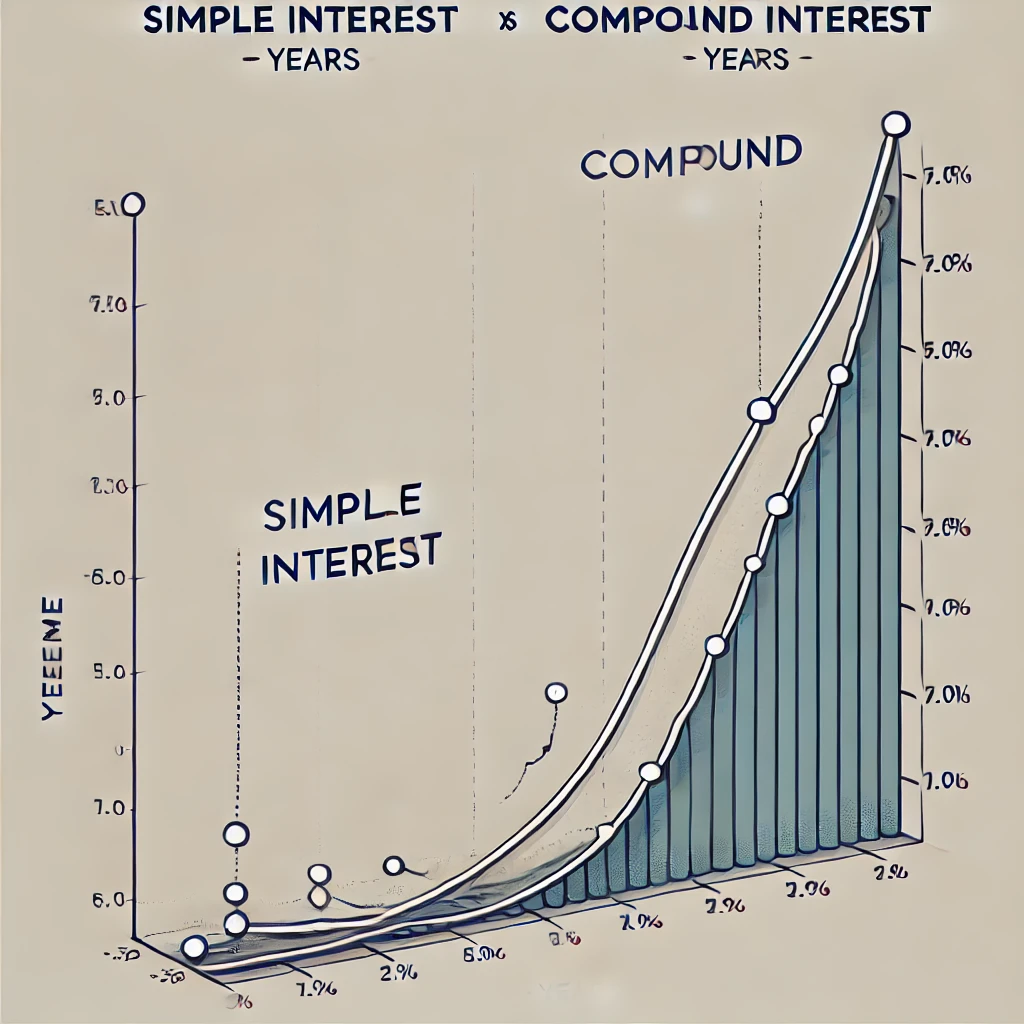

- What’s the difference between fixed-rate and variable-rate mortgages?

- A fixed-rate mortgage has a constant interest rate over the loan’s life, while a variable-rate mortgage (VRM) has a lower initial rate that adjusts periodically based on market rates.

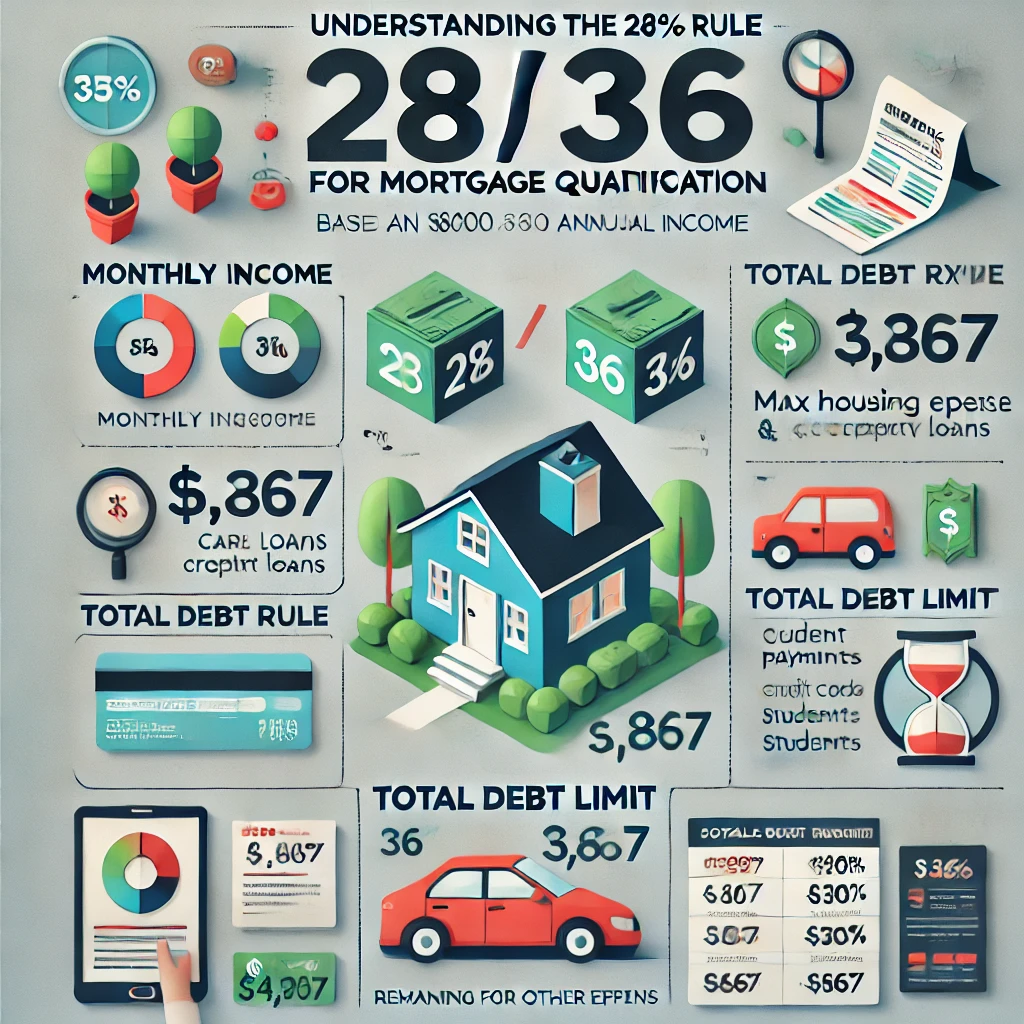

- How much can I afford to spend on a home?

- Your affordability depends on income, debt, credit score, down payment, and other financial commitments. A lender can help provide a realistic budget based on these factors.

- Do I need a real estate agent, and how do I choose one?

- A real estate agent offers guidance, handles paperwork, and negotiates on your behalf. Choose an agent based on experience, local knowledge, and a good personality fit.

- What’s the difference between being pre-approved and making an offer?

- Pre-approval confirms your loan eligibility, while making an offer is your official bid to purchase a property at a specific price and terms.

- When is the best time to buy a home?

- The best time depends on personal readiness and market conditions. Spring and summer typically have more listings, while fall and winter may offer better deals.

- What are property taxes, and how are they paid?

- Property taxes fund local services like schools and infrastructure. They are usually paid annually or semi-annually, either directly or through an escrow account with your mortgage.

- Can I still buy a home if I have student loans or other debt?

- Yes, as long as your debt-to-income (DTI) ratio falls within the lender’s limits. DTI considers monthly debts relative to your income.

- What happens if my offer is rejected?

- You can make a higher offer, adjust terms, or continue looking at other homes. Your agent will advise on how best to proceed.

- What’s earnest money, and is it refundable?

- Earnest money is a deposit showing serious intent to buy. It’s typically refundable if you back out within contingencies but may be forfeited if you withdraw without cause.

- What is title insurance, and why do I need it?

- Title insurance protects you and your lender from legal issues related to property ownership. It’s typically required by lenders.

- How soon after closing can I move in?

- Usually, you can move in immediately after closing unless the agreement includes a delayed possession date.

- How do I know if a home is priced fairly?

- Your agent will perform a Comparative Market Analysis (CMA) to determine if the price aligns with recent similar property sales in the area.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "