How to Become Financially Free Through Real Estate in Your 20s

1. Why Real Estate is a Path to Financial Freedom

Real estate is one of the most proven methods for building long-term wealth, and starting in your 20s gives you a massive advantage. Unlike traditional savings or stock market investments, real estate provides multiple income streams, such as rental income, appreciation, and tax advantages. By leveraging these benefits early, you can build wealth more quickly than through other investment options.

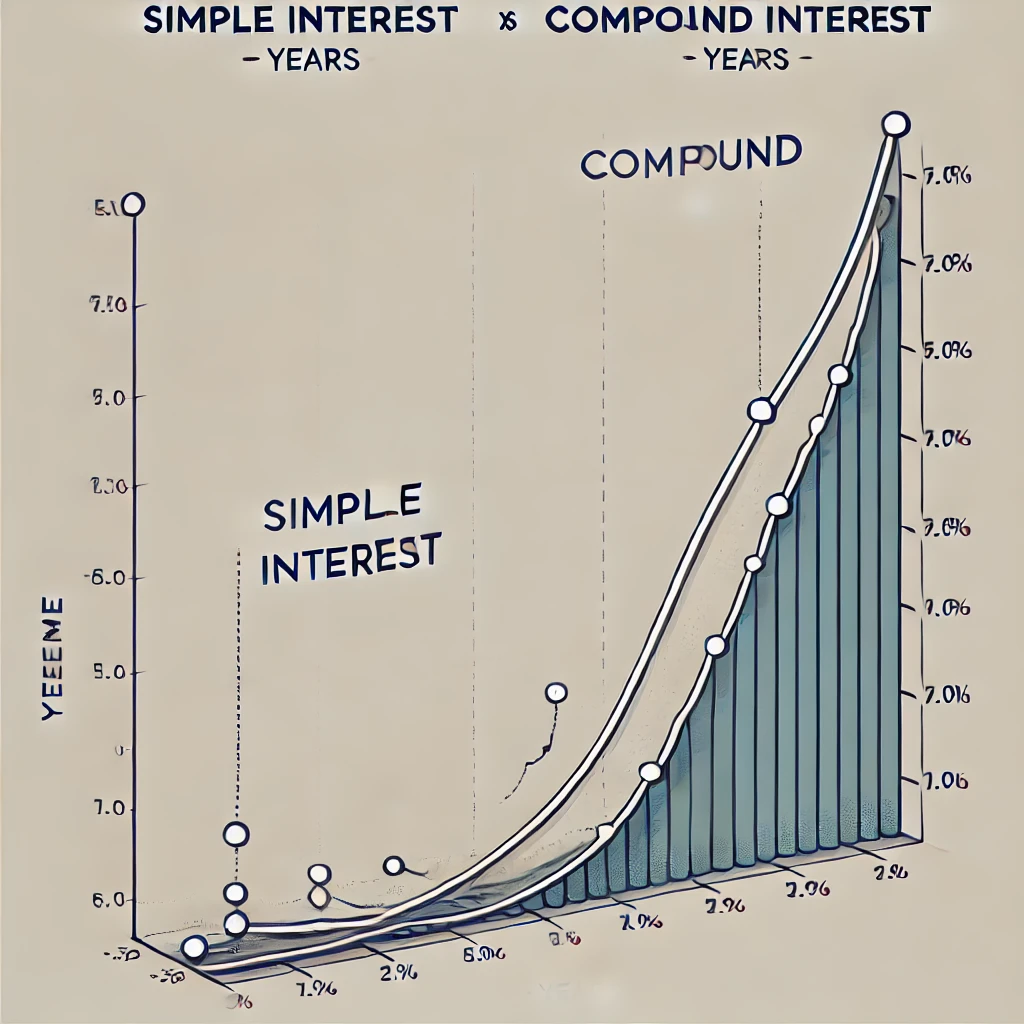

One major advantage of real estate is the power of leverage. Through loans and financing, you can control a large asset with a relatively small down payment, allowing you to grow your portfolio even with limited upfront capital. Additionally, starting young enables you to take advantage of compound growth, where appreciation and reinvested earnings snowball over time.

2. How to Educate Yourself Before Investing

Before jumping into real estate, it’s critical to educate yourself. Research market trends, understand financing options, and learn about property management. Take advantage of free online resources, books like Rich Dad Poor Dad, and local real estate meetups.

Building a network of mentors, real estate agents, and other professionals will accelerate your learning curve. These connections can provide valuable insights into areas like negotiation, identifying undervalued properties, and securing financing.

Moreover, understanding the risks and rewards of different types of real estate—such as single-family homes, multifamily properties, or REITs—will help you make informed decisions. For instance, multifamily properties can offer consistent cash flow, while single-family homes often provide better appreciation potential.

3. Finding and Financing Your First Property

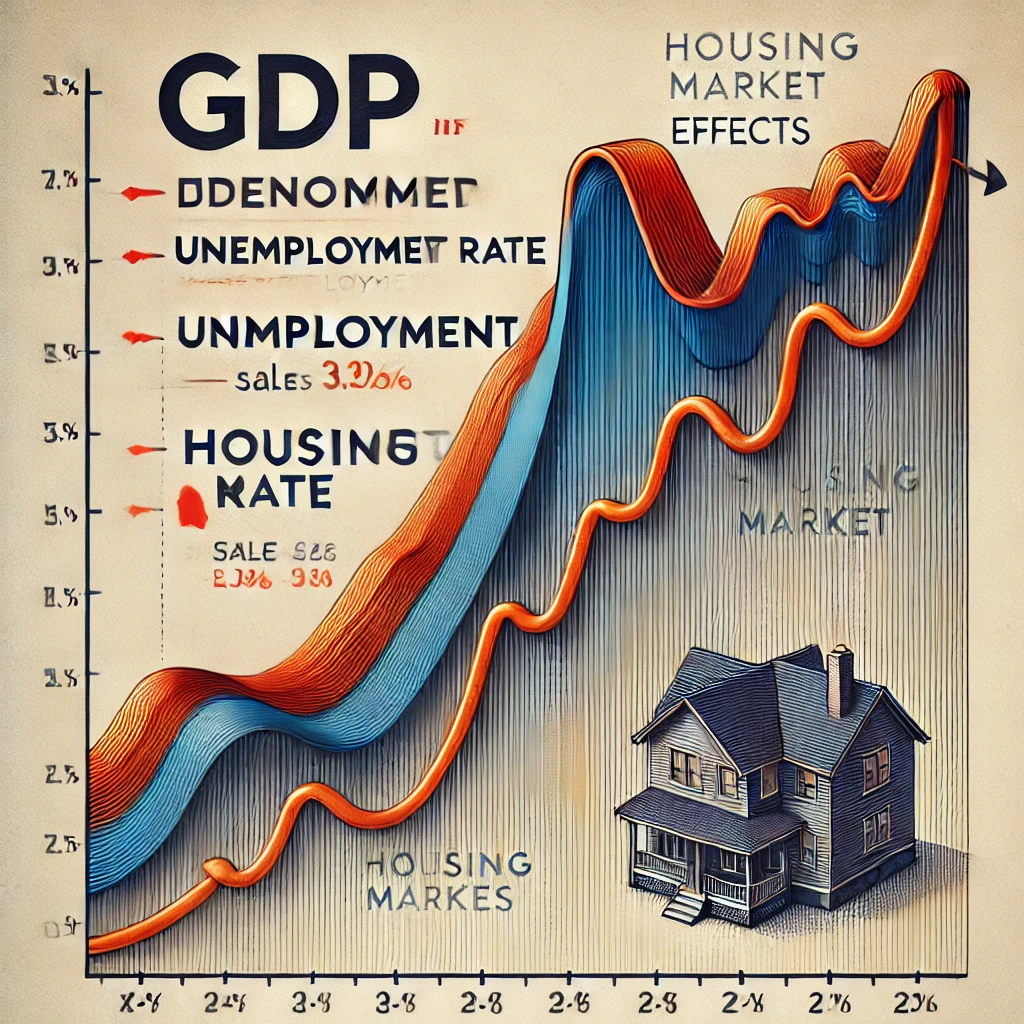

One of the most intimidating steps is finding and financing your first property. Start by analyzing local markets to identify areas with growth potential, lower property prices, and higher rental demand. Look for neighborhoods near universities, growing job hubs, or areas undergoing revitalization.

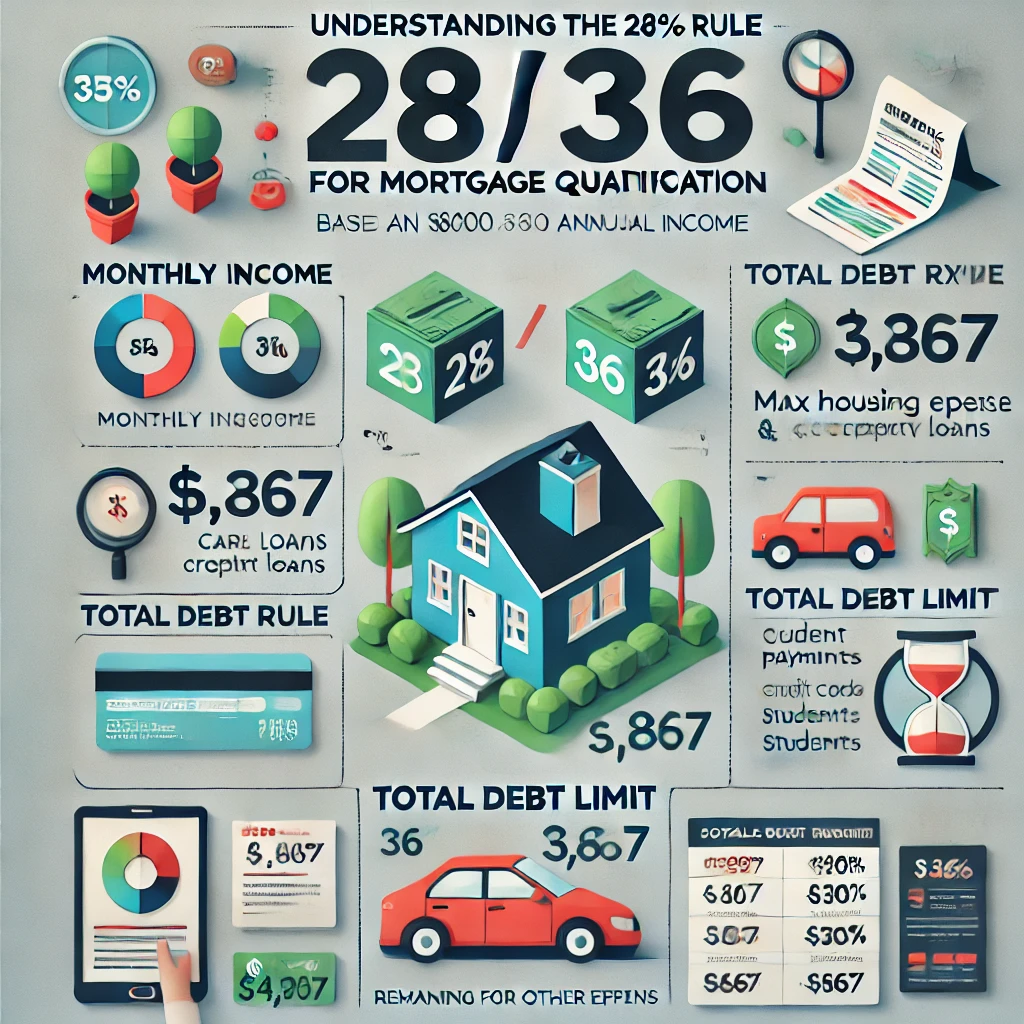

Financing can seem daunting, but first-time homebuyer programs, FHA loans, or even partnering with friends or family can make it accessible. FHA loans, for example, allow you to purchase a property with as little as 3.5% down. House hacking—buying a multifamily property and living in one unit while renting out the others—can help you cover your mortgage and potentially generate profit.

4. Scaling Your Portfolio Over Time

Once you’ve acquired your first property, the next step is scaling. Reinvest profits from your rental income into additional properties. Many successful investors use strategies like the BRRRR method (Buy, Rehab, Rent, Refinance, Repeat) to expand their portfolio quickly.

In your 20s, time is on your side. Using long-term strategies such as cash flow reinvestment, debt reduction, and tax deferral methods like a 1031 exchange can lead to exponential portfolio growth. By reinvesting wisely, you can generate passive income that covers all your living expenses, a hallmark of financial freedom.

5. Mindset and Habits for Long-Term Success

Achieving financial freedom through real estate in your 20s requires discipline, patience, and a long-term mindset. Focus on budgeting, minimizing unnecessary expenses, and saving aggressively for down payments. Stay consistent with your investments, even during market downturns, as these periods often present the best opportunities.

Surround yourself with like-minded individuals who share similar goals. Join real estate groups, attend networking events, and stay updated on industry trends. Remember, real estate is not a get-rich-quick scheme—it’s a marathon, not a sprint.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "