How to Calculate Rental Income – Huge Mistake Most Investors Make

The Importance of Accurate Rental Income Calculation

For new and seasoned real estate investors alike, calculating rental income is one of the most critical steps to determining whether a property is a good investment. It sounds straightforward—calculate rent, subtract expenses, and voilà! Unfortunately, many investors fall into the trap of miscalculating rental income, leading to poor financial outcomes. The biggest mistake? Ignoring hidden costs and overestimating profits.

Step 1: Define Gross Rental Income

The first step is understanding gross rental income, which is the total income generated by renting out a property before any expenses are deducted. For example, if you charge $1,500 per month in rent, your gross rental income is $18,000 annually. However, this figure can vary based on vacancies, late payments, or rental price adjustments.

Many investors overestimate this number by assuming properties will always be rented 100% of the time, which isn’t realistic. Factoring in a vacancy rate of 5-10% will provide a more accurate gross rental income calculation.

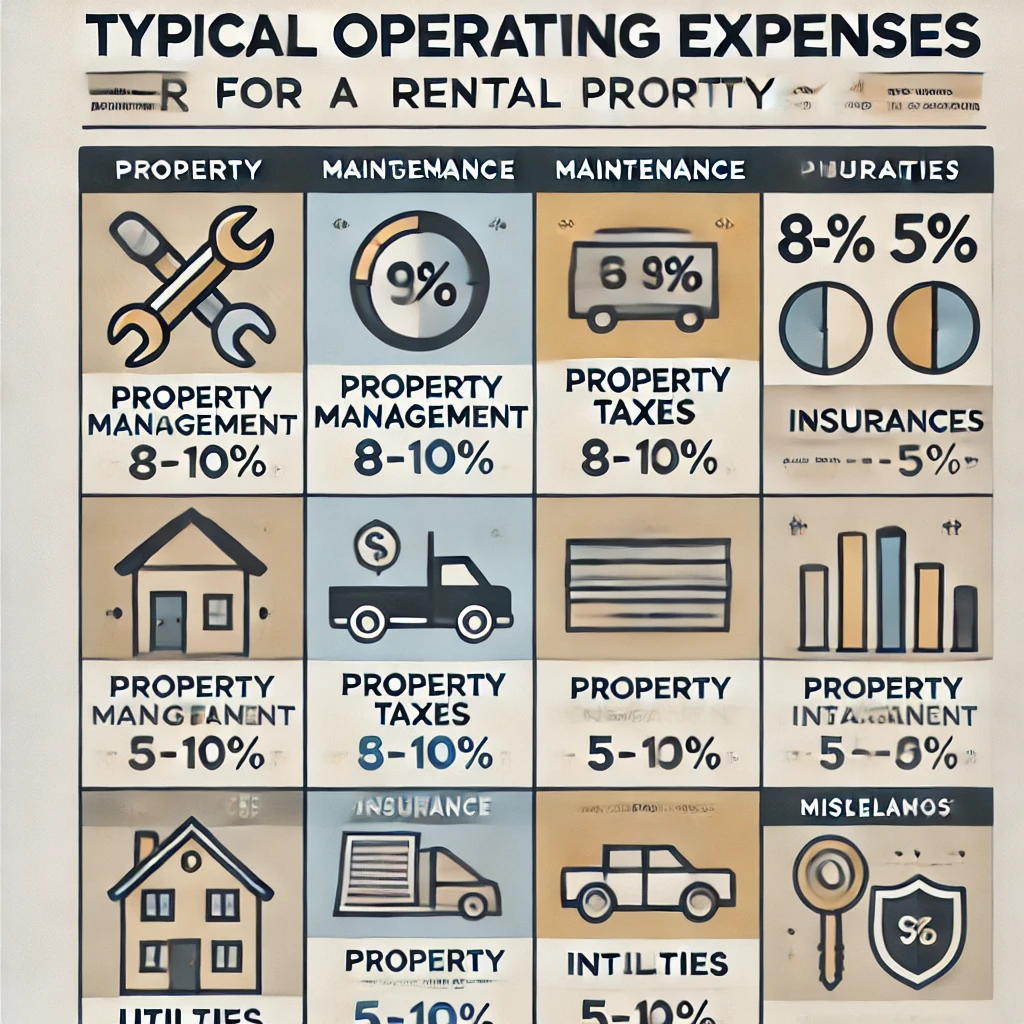

Step 2: Account for Operating Expenses

Once you’ve determined your gross rental income, it’s time to subtract operating expenses. These include property taxes, insurance, maintenance, property management fees, utilities, and any HOA dues.

A common mistake? Underestimating maintenance costs. Repairs can range from replacing a broken appliance to major renovations, and an average of 1% of the property value annually is a good benchmark for maintenance reserves.

Step 3: Don’t Forget Financing Costs

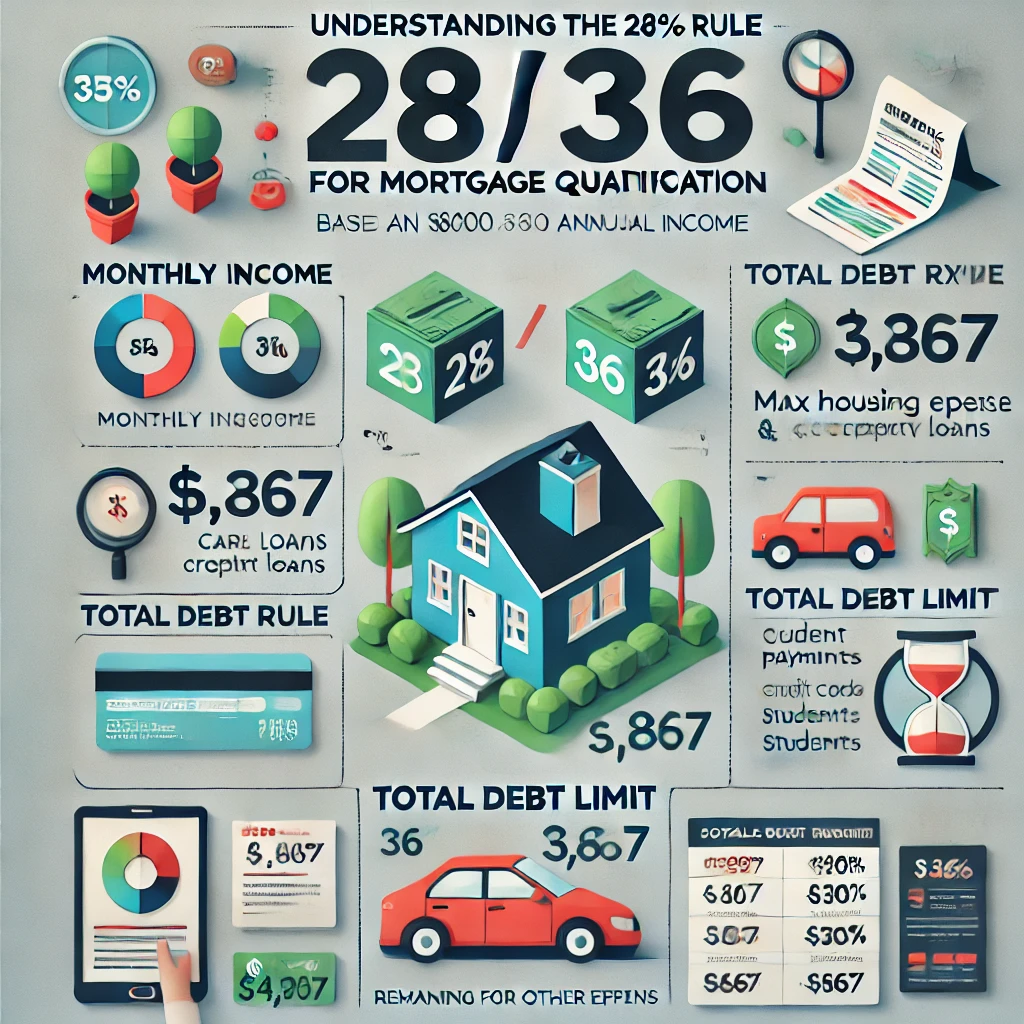

Financing costs, including mortgage payments and interest, are often overlooked when calculating rental income. If you have a loan on the property, you must include these expenses to get a true picture of your cash flow. For instance, if your monthly mortgage payment is $1,200, and you’re only generating $1,500 in rent, you’re left with just $300 before other expenses are deducted.

Ignoring this step can lead to significant financial strain for investors who think their properties are cash-flow positive when they’re actually not.

Step 4: Calculate Net Rental Income

Net rental income is what’s left after all expenses, financing costs, and vacancy adjustments. This is the most critical number for investors because it determines whether a property is profitable. Use this formula:

Net Rental Income = Gross Rental Income - (Operating Expenses + Financing Costs + Vacancy Adjustments)

For example:

- Gross Rental Income: $18,000

- Operating Expenses: $6,000

- Mortgage Costs: $14,400

- Net Rental Income: Negative $2,400 annually

In this scenario, the investor would actually lose money on the property—an outcome that could have been avoided with proper calculations.

Step 5: Plan for the Unexpected

Another major mistake investors make is failing to budget for unexpected expenses. From emergency repairs to legal disputes with tenants, surprises can drastically impact your rental income. Building an emergency fund that covers at least 3-6 months of expenses is essential for long-term success.

Additionally, consider market conditions. Economic downturns, local market changes, or increased competition can all affect your ability to generate consistent rental income. Smart investors plan for these fluctuations by diversifying their income sources and regularly reviewing their property’s performance.

Conclusion: Avoiding the Big Mistake

To summarize, the biggest mistake investors make when calculating rental income is failing to account for all the expenses and adjustments needed to get an accurate number. Overestimating income or underestimating costs can quickly turn a promising investment into a financial burden. By following these steps—calculating gross rental income, subtracting operating and financing costs, and planning for unexpected expenses—you’ll have a more realistic understanding of your property’s potential.

Proper calculations not only help you avoid financial mistakes but also empower you to make smarter investment decisions. Want to dive deeper into managing rental property finances? Download our free rental income worksheet to simplify the process!

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "