How to Leverage a HELOC to Buy Multiple Properties: A Smart Investor's Guide

For real estate investors, building a property portfolio can seem daunting, especially if upfront capital is limited. However, a powerful strategy exists for those who already own a home: leveraging a Home Equity Line of Credit (HELOC). This method allows you to use your home’s existing equity to fund the purchase of additional properties. In this blog, we'll break down how you can use a HELOC to buy multiple properties, the benefits of doing so, and the risks to be aware of.

- Building Sufficient Equity in Your Home

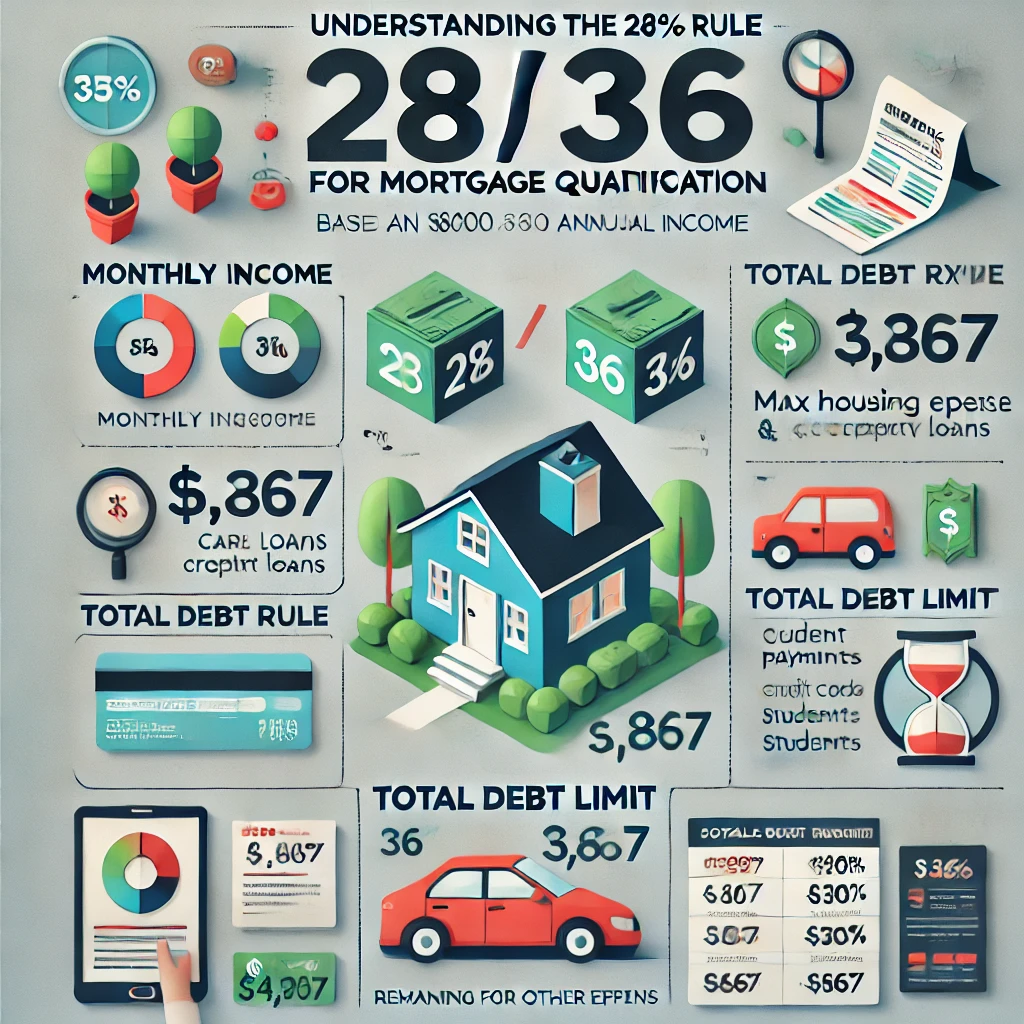

The first step in leveraging a HELOC is to build enough equity in your primary residence or another investment property. Equity is the difference between your property’s market value and the remaining mortgage balance. Over time, as you pay down your mortgage and as the property appreciates, your equity grows. Once you've accumulated sufficient equity (usually at least 20%), you can apply for a HELOC and access up to 85% of your home’s value.

- How a HELOC Works

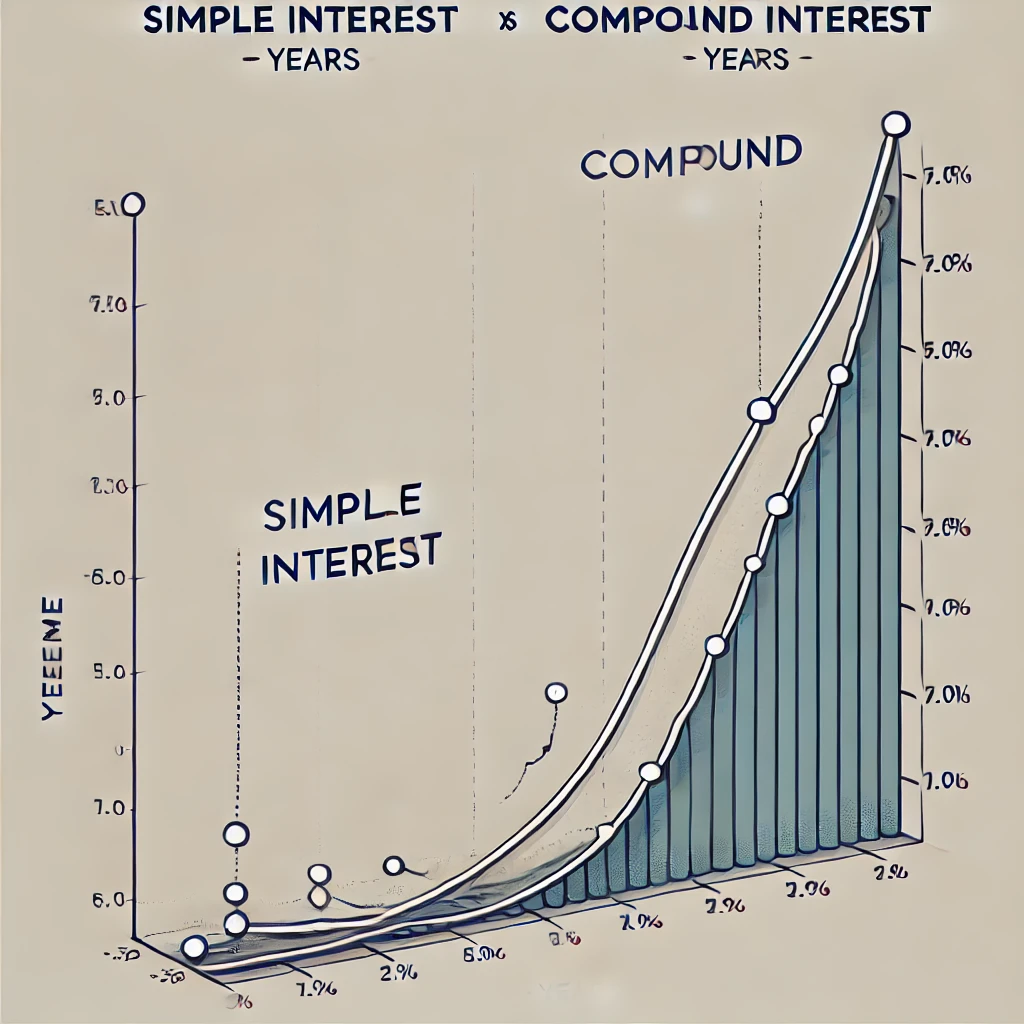

A HELOC allows you to borrow against your home’s equity via a revolving line of credit, similar to a credit card. The great thing about HELOCs is that you only pay interest on the amount you withdraw, and as you repay it, the credit line becomes available again. Most lenders will let you borrow 75-85% of your home’s equity. Once your HELOC is approved, you can use it for property down payments or even full purchases.

- Using a HELOC to Buy Investment Properties

One common strategy is to use your HELOC as a down payment for investment properties. For example, if you find a $400,000 rental property, you can use $80,000 from your HELOC for the 20% down payment and finance the remaining $320,000 with a traditional mortgage. The beauty of this approach is that the rental income from your new property can help pay down the HELOC, allowing you to repeat the process for future investments.

- Expanding Your Portfolio Over Time

As your rental properties appreciate in value and you pay down your HELOC, your equity continues to grow. This means you can eventually tap into more equity to purchase additional properties. By continually reinvesting, you can build a diversified real estate portfolio without needing large amounts of cash upfront. The key to success here is being strategic: ensure that your rental income covers both your mortgage and your HELOC payments.

- Risks and Considerations

While leveraging a HELOC to buy multiple properties can be lucrative, it's not without risks. HELOCs typically come with variable interest rates, which can increase over time, raising your payments. Over-leveraging is another potential danger—if property values decline or rental income is insufficient, you could face financial strain. Additionally, because a HELOC is secured by your home, defaulting could result in losing your residence. Always plan your investments carefully and ensure that you have sufficient cash flow.

Conclusion:

Leveraging a HELOC is a smart way to grow your real estate portfolio without needing a large upfront investment. By using your home’s equity strategically, you can purchase multiple properties, generate rental income, and build long-term wealth. However, always weigh the risks and consult with a financial advisor before diving into this investment strategy. With careful planning, a HELOC could be the key to unlocking your real estate dreams.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "