Is It the Right Time to Buy a Property?

Deciding whether it’s the right time to buy a property is a significant financial decision that requires careful consideration of various factors. Market conditions, personal finances, and long-term goals all play a crucial role in determining the right timing for such an investment. Here’s a comprehensive guide to help you evaluate whether now is the right time to buy a property.

- Current Market Conditions

Understanding the current real estate market conditions is essential. In a buyer’s market, there are more properties available than buyers, leading to lower prices and more negotiating power. Conversely, a seller’s market has more buyers than available properties, driving up prices. Research local market trends, inventory levels, and price changes to get a sense of whether it’s an opportune time to buy.

- Interest Rates

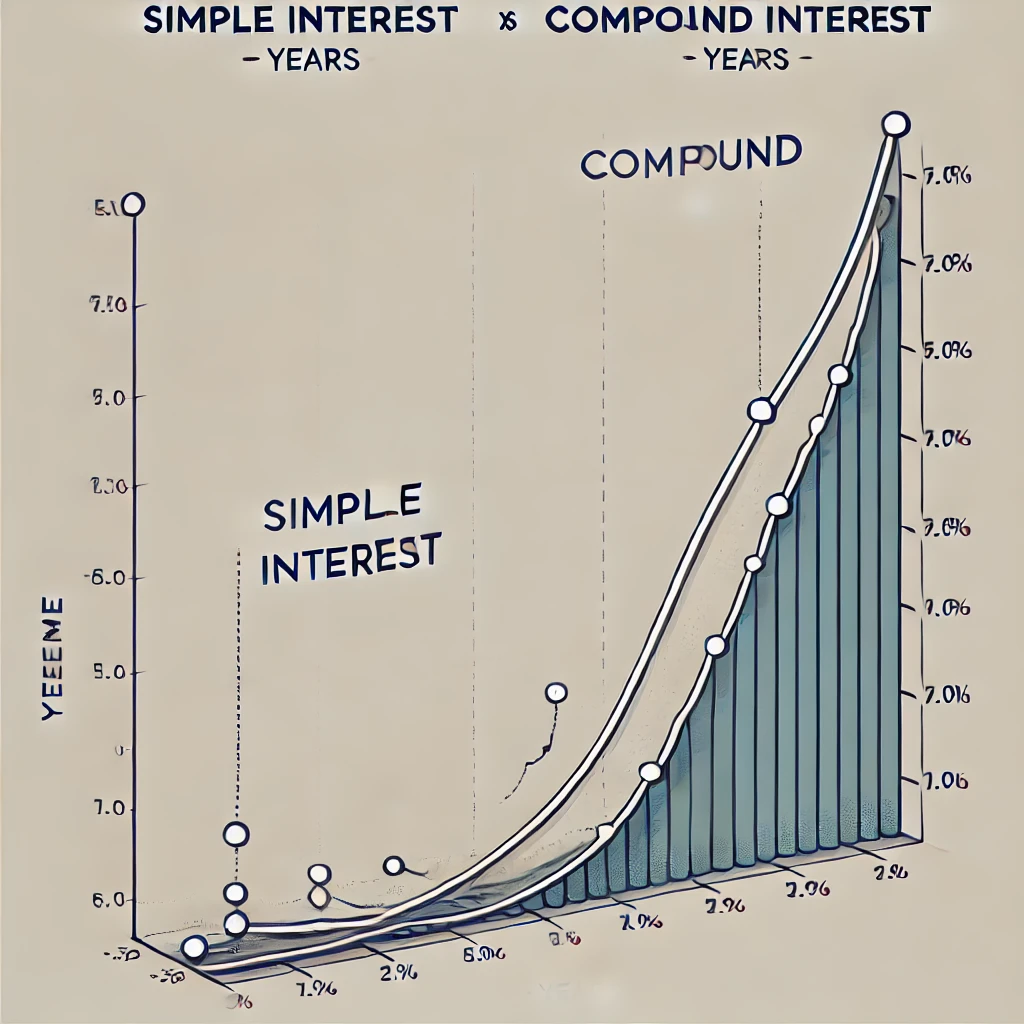

Interest rates significantly impact the cost of your mortgage. Lower interest rates reduce your monthly payments and the total cost of the loan over time. Monitor the current interest rate trends and forecasts. Even a slight increase in interest rates can affect your purchasing power and the overall affordability of the property.

- Personal Financial Situation

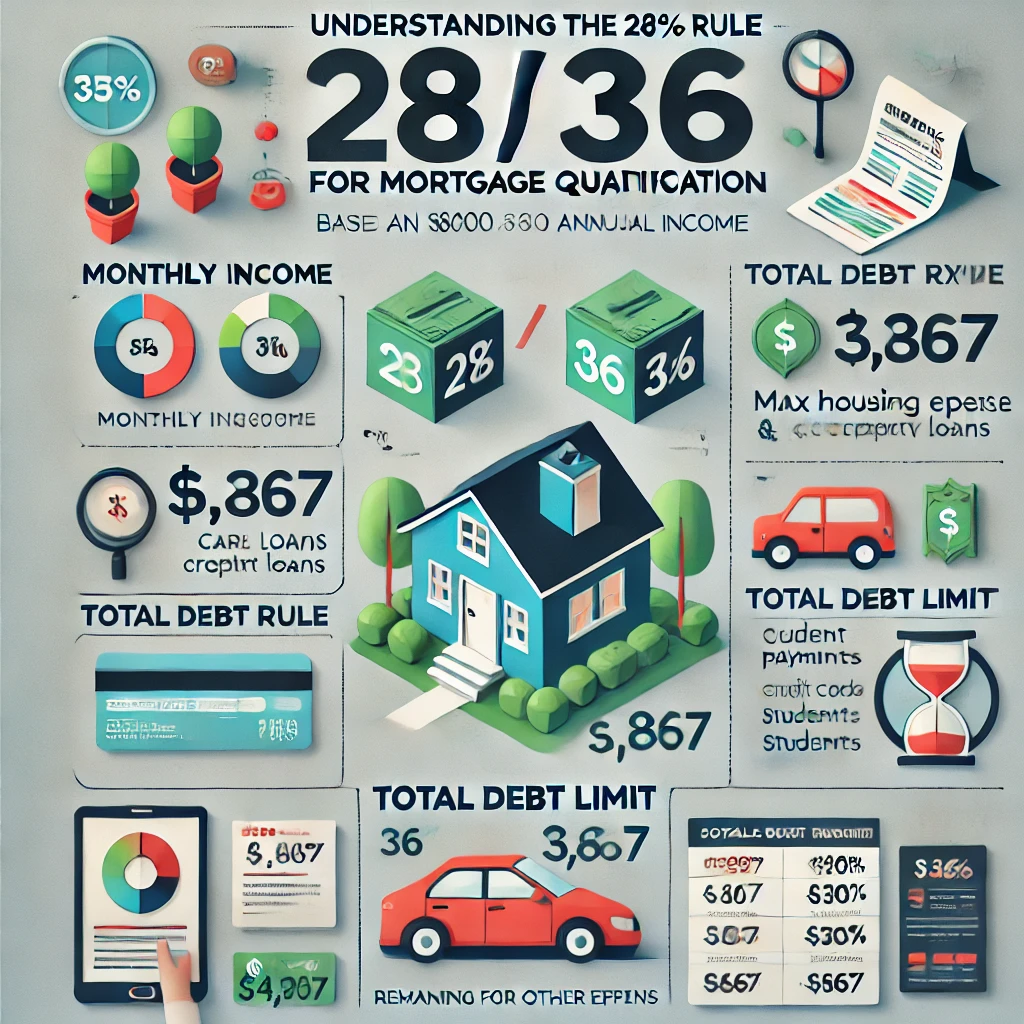

Your financial health is a critical factor in deciding whether to buy a property. Ensure you have a stable income, a good credit score, and enough savings for a down payment and closing costs. A sound financial position will not only help you secure a mortgage at favorable terms but also ensure you can comfortably manage ongoing expenses such as maintenance, property taxes, and insurance.

- Long-Term Goals

Consider your long-term goals and how buying a property fits into them. Are you planning to stay in the area for several years? Buying a property is a long-term investment, and it’s generally advisable to plan to stay put for at least five to seven years to build equity and offset the costs of buying and selling.

- Economic Indicators

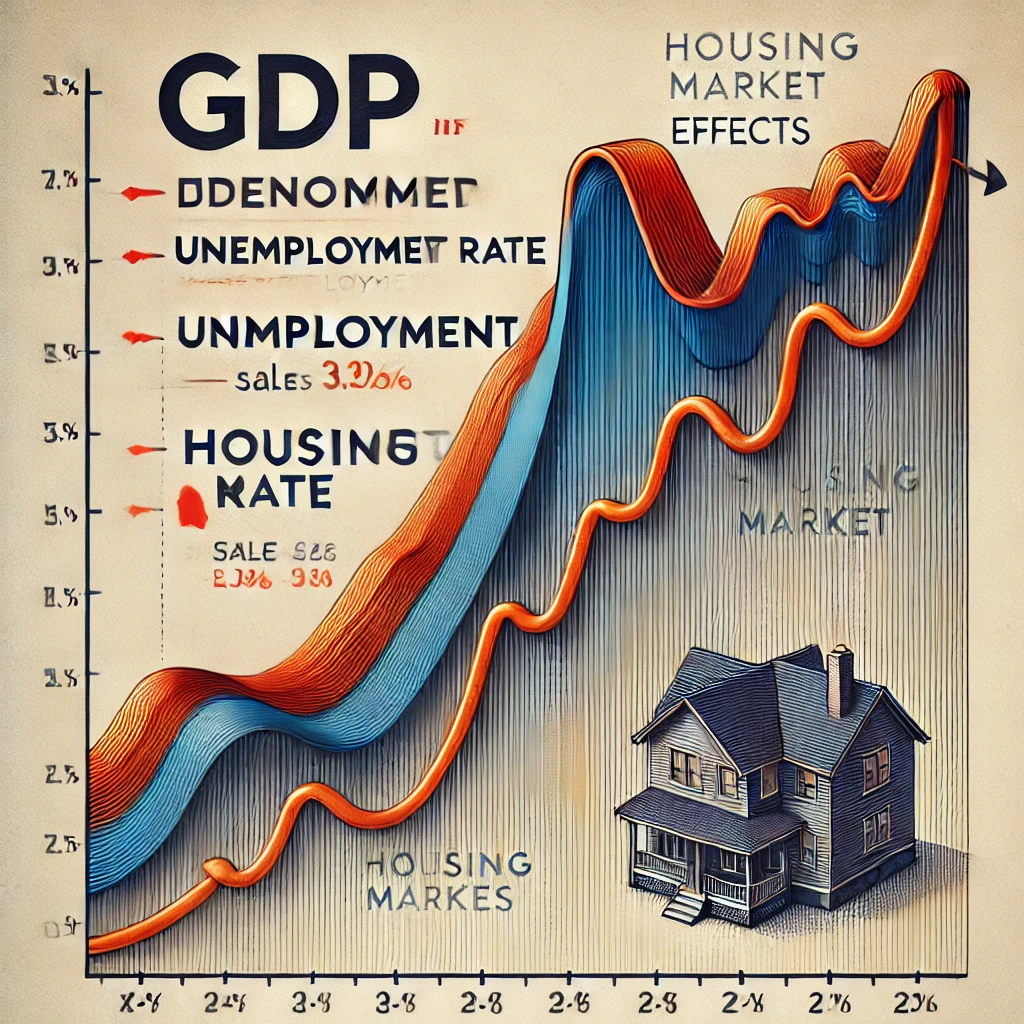

Broader economic indicators can also influence the decision to buy a property. Look at employment rates, inflation, and economic growth forecasts. A strong economy typically supports a robust housing market, while economic downturns can lead to uncertainty and potential declines in property values.

- Rental Market Conditions

If you are currently renting, compare the cost of renting versus buying. In some markets, renting may be more cost-effective in the short term, especially if property prices are high and expected to decline. However, buying a property allows you to build equity over time, which renting does not offer.

- Supply and Demand Dynamics

Evaluate the supply and demand dynamics in the area where you’re considering buying. High demand and low supply can drive prices up, making it a seller’s market. Conversely, high supply and low demand can provide more opportunities for buyers to negotiate better deals.

- Government Policies and Incentives

Government policies, incentives, and tax benefits for homebuyers can also influence your decision. Research any first-time homebuyer programs, tax credits, or grants that may be available to you, as these can significantly reduce the financial burden of purchasing a property.

Conclusion

There is no one-size-fits-all answer to whether it’s the right time to buy a property. It depends on a combination of market conditions, personal financial health, and long-term goals. By carefully analyzing these factors and staying informed about current trends, you can make a well-informed decision that aligns with your financial situation and future aspirations.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "