Top 5 Rules for Real Estate Investing

1. Location Is Key

The saying "location, location, location" has become a cliché for a reason. The location of a property largely determines its long-term value and rental income potential. Investing in neighborhoods with strong job markets, good schools, and low crime rates ensures demand and appreciation over time. Proximity to amenities like public transportation, shopping centers, and parks also boosts a property’s desirability.

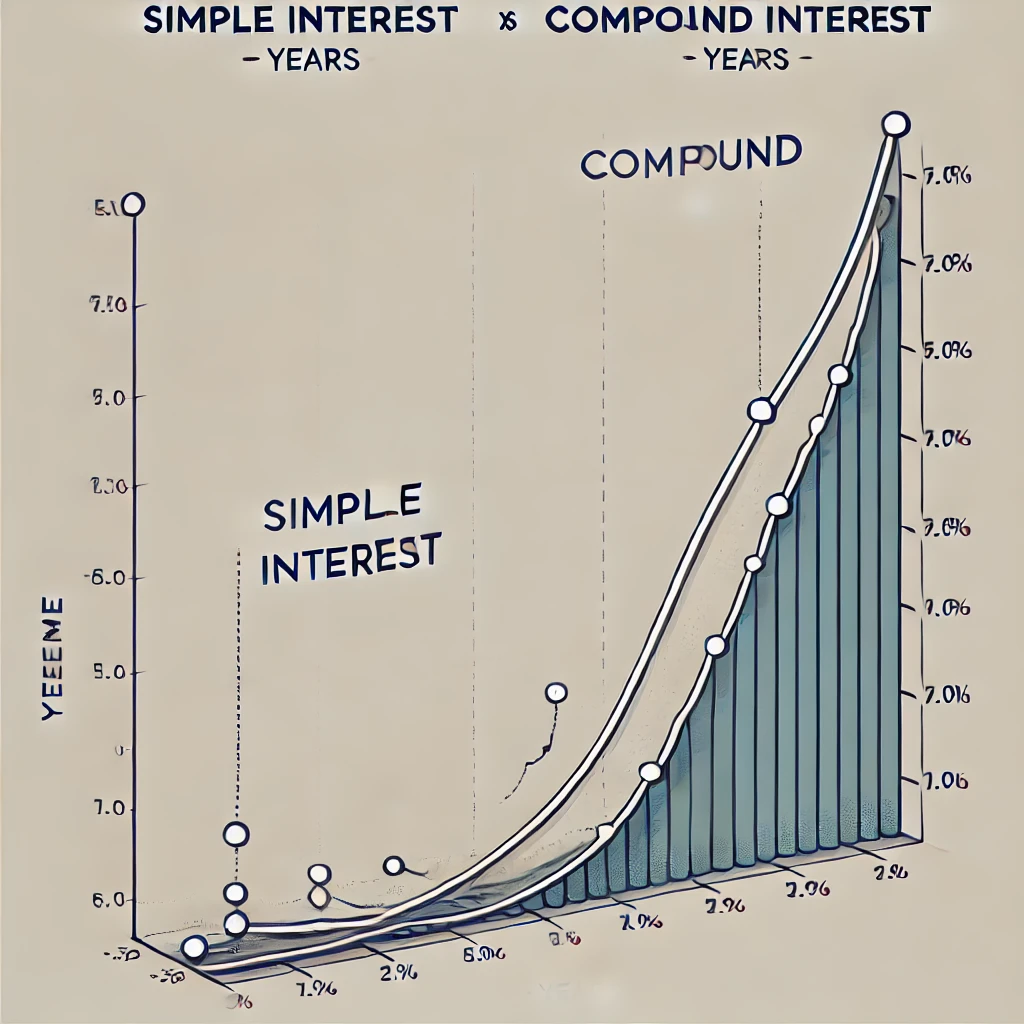

2. Understand Cash Flow

Positive cash flow is the foundation of a sustainable real estate portfolio. This means your rental income should exceed your monthly expenses, including the mortgage, property taxes, insurance, and maintenance costs. Always analyze the numbers carefully before buying, and don’t underestimate the impact of unexpected expenses like repairs or vacancies.

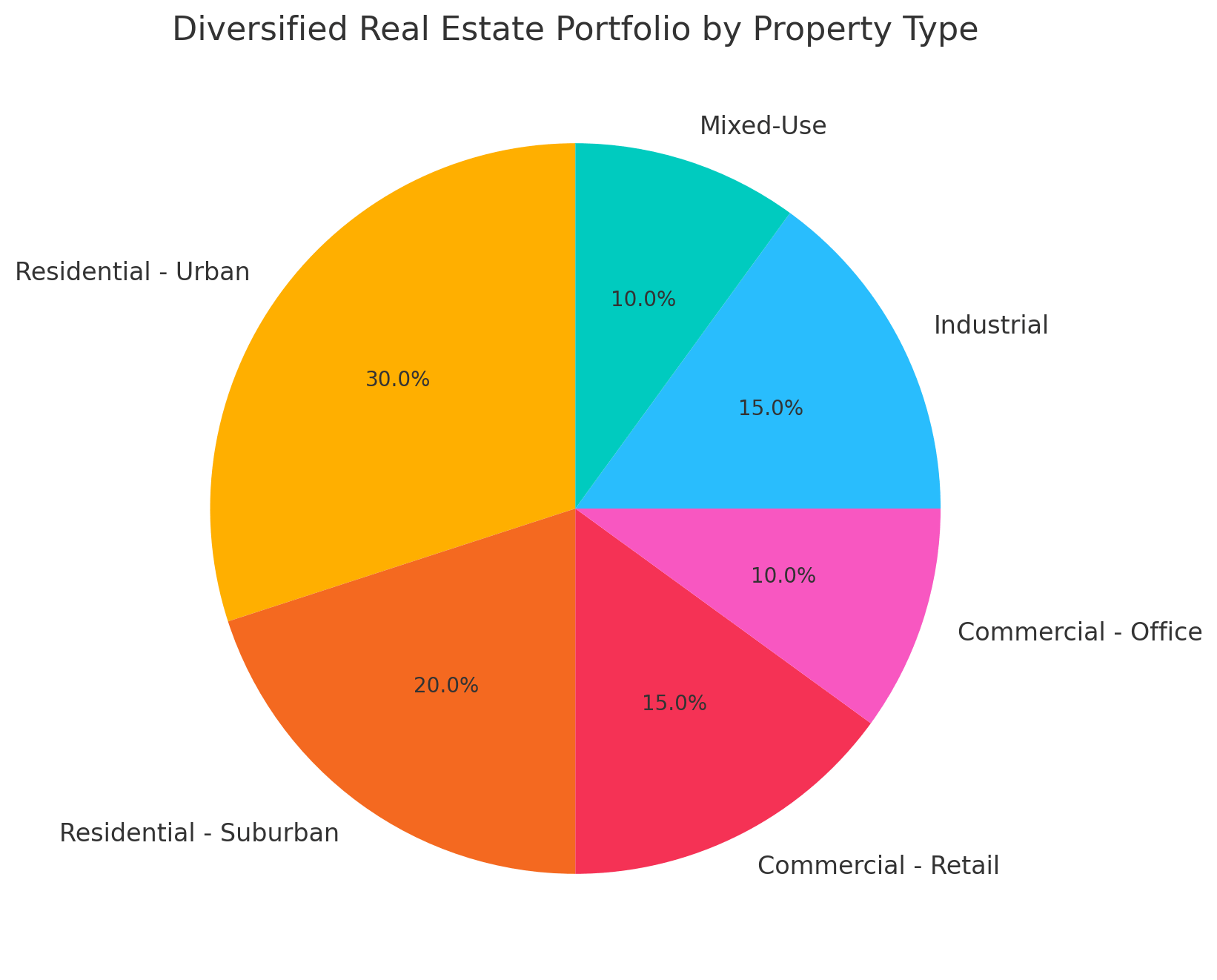

3. Diversify Your Portfolio

Relying on a single type of property or market can expose you to unnecessary risk. To build a resilient portfolio, diversify across property types (residential, commercial, or multi-family) and geographic locations. This approach mitigates the impact of economic downturns or market-specific challenges.

4. Research Market Trends

Real estate markets are constantly evolving. Understanding current trends, such as interest rate fluctuations, housing supply, and demand, gives you an edge in making informed decisions. Tools like market analysis reports and local real estate forums can provide valuable insights to help you stay ahead of the curve.

5. Network and Build a Team

Successful real estate investing isn’t a solo endeavor. Building a team of trusted professionals—including a real estate agent, property manager, attorney, and contractor—can save you time and money. Networking with other investors can also lead to partnerships, off-market deals, and shared knowledge.

Conclusion

Real estate investing can be a rewarding way to generate wealth, but it requires careful planning and a commitment to learning. By focusing on these five rules—location, cash flow, diversification, market research, and building a strong network—you’ll be better equipped to navigate the challenges of the industry and achieve long-term success.

Would you like a CSV workbook to help analyze potential investments or any additional resources on market research? Let me know how I can support your real estate journey!

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "